In recent years, the conditions of competition in the global environment have changed for the companies. The market is dominated by constant change, complex tasks and environmental turbulence. As knowledge, innovation and flexibility become an important resource for sustained competitive advantage and ‘Entrepreneurship’ is the crucial factor for success or survival. While small firms take the advantage of these conditions and become very successful due to their flexible structure and entrepreneurial spirit, large firms suffer more due to their mechanistic, bureaucratic and rigid structures. One of the solutions for companies to deal with the rigid bureaucratic structures is to induce Corporate Entrepreneurship in their structure. While CEOs are concerned about profitable organic growth, they find corporate entrepreneurship or creating a new business as one of the solution. As corporate entrepreneurship is becoming popular, it can be seen as a school within entrepreneurship theory. Since there is no generally accepted definition Continue reading

Strategic Management

Strategic management is the art and science of formulating, implementing and evaluating cross-functional decisions that will enable an organization to achieve its objectives. It involves the systematic identification of specifying the firm’s objectives, nurturing policies and strategies to achieve these objectives, and acquiring and making available these resources to implement the policies and strategies to achieve the firm’s objectives. Strategic management, therefore, integrates the activities of the various functional sectors of a business, such as marketing, sales, production etc. , to achieve organizational goals. It is generally the highest level of managerial activity, usually initiate by the board of directors and executed by the firm’s Chief Executive Officer (CEO) and executive team.

Competitive Advantage of First Mover and Late Mover Strategies

Nowadays due to technology advancement, the way of how businesses were conducted has evolved to be more globally attributed and dependable to technological innovation aids. Furthermore, technology could help a firm to be sustained by having competitive advantage, and this especially true in the situation of where firm had the strong dependency towards technology innovation. Technology had becomes more important to specific firm or business when it has the ability to significantly affect their competitive advantage or industry structure. Thus, it is important for firms to choose and execute their strategy systematically to stay competitive and sustainable in the market. There are 3 ways of how first-mover could achieve their advantages. The first sources of how first-mover competitive advantage could be triggered are (i) technological leadership, (ii) preemption of assets, and (iii) buyer switching cost. Technological leadership will benefit first-mover in term of leadership in innovation, which ensure the sustainability Continue reading

Environmental Turbulence Concept in Strategic Management

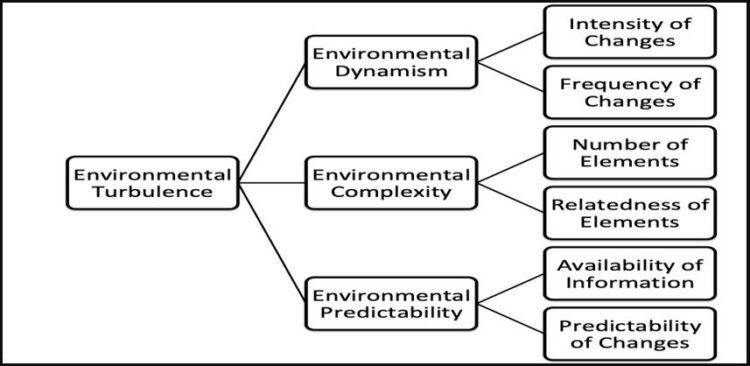

Business environments are described or analysed in various ways based on disparate important dimensions. However, the concept of turbulence is ambiguous. This confusion touches on the varying orientations in studying organisational environments and the diverse methods that are used to measure it. Environmental turbulence underscores the extent of change and degree of complexity in a business environment. Changes in technology, statutory regulations, or environmental factors are some of the examples that constitute environmental turbulence. Therefore, a turbulent environment is dynamic, expanding, unpredictable, and fluctuating. In addition, such an environment displays high levels of interconnectedness with the business. Turbulence is a complex interaction of several dimensions that are related to change where some elements dominate others or overlap each other at times. The figure below shows the configuration of the main dimensions of environmental turbulence. 1. Dynamism If the components of the tasks of the environment are highly variable, the business needs Continue reading

Internal and External Influences on Business Environment

In today’s dynamic business environment, organisations are subject to a myriad of influences that shape their operations, strategies, and overall performance. These influences can be broadly categorised into internal and external factors, each playing a crucial role in determining a company’s success or failure. By understanding these influences, businesses can develop robust strategies to navigate challenges and capitalise on opportunities in an ever-changing marketplace. Internal Influences on Business Environment 1. Organisational Structure and Culture One of the most significant internal influences on a business is its organisational structure and culture. The way a company is structured can greatly impact its efficiency, decision-making processes, and overall performance. Organisational structure defines how tasks are formally divided, grouped, and coordinated within a company. A well-designed structure can facilitate communication, enhance productivity, and foster innovation. Conversely, a poorly designed structure may lead to inefficiencies, conflicts, and reduced performance. Organisational culture, on the other hand, refers Continue reading

The Relationship between Sustainability and Innovation

Advancement in technology and the changing lifestyles of people requires flexibility and adaptation for business to survive. Technology has affected the way business is conducted around the globe. Opportunities present are friendly to innovative people who are able to come up with different strategies to solve problems that face human beings. Innovation and sustainability have become pertinent in business’ success. Concept of Sustainability Sustainability is a term used in reference to the need to conserve natural environments. It therefore implies that all things that are important to people’s lives depend on the environment. People thrive and survive because of their environment, which allows them to gain access to water and other important resources that are pertinent to their general life ad health. Therefore, ensuring that these environments are conserved should be their obligation. Businesses and individuals need to take the initiative of ensuring that the surrounding environment is protected from bad Continue reading

Mergers and Acquisitions (M&A) – Definition, Types, and Process

Mergers and Acquisitions (M&A) are increasingly becoming a novel approach for companies to wade through the competitive pressures of today’s globalized society. The increase of mega-mergers in today’s corporate world demonstrates the entrenchment of such transactions in modern business practices. Definitions of Mergers and Acquisitions “One plus one equals three”. This statement defines the main logic that informs merger and acquisition transactions. This logic stems from the fact that most companies aim to create a bigger shareholder value than the sum of the shareholder value that would ordinarily be realized if two corporate entities merge. The reasoning behind merger and acquisition transactions therefore stems from the fact that there is a greater value when two companies work together, as opposed to two companies working in isolation. Mergers and Acquisitions (M&A) are therefore joint activities where the activities of two or more companies merge to create one common purpose for both Continue reading