Working capital is said to be the life blood of a business. Working capital signifies funds required for day-to-day operation of the firm. In financial literature, there exist two concepts of working capital namely: gross and net. Accordingly, gross concept working capital refers to current assets viz: cash, marketable securities, inventories of raw materials, work-in-process, finished goods and receivables. According to net concept, working capital refers to the difference between current assets and current liabilities. Ordinarily, working capital can be classified into fixed or permanent and variable or fluctuating parts. The minimum level of investment in current assets regularly employed in business is called fixed or permanent working capital and the extra working capital needed to support the changing business activities is called variable or fluctuating working capital. There are broadly 3 working capital management strategies/ approaches to choose the mix of long and short-term funds for financing the net working capital of a firm viz. Conservative, Aggressive, Hedging (Or Maturity Matching) approach. These strategies are different because of their different trade-off between risk and profitability. Another remarkable difference is the extent or proportion of application of long and short-term fund to finance the working capital.

The terms ‘methods of working capital management’, ‘strategies and approaches to working capital management’ are interchangeably used in general parlance. But, ultimately the concept and achievement of the objective of working capital management are important. We need to understand the following relationship in depth for understanding the concept in its true sense.

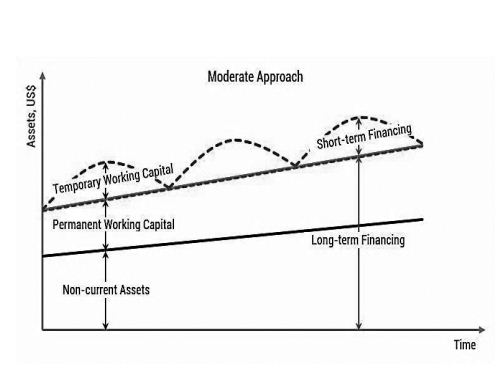

1. Hedging (Maturity Matching) Approach to Working Capital Management

The term ‘hedging’ usually refers to two off-selling transactions of a simultaneous but opposite nature which counterbalance the effect of each other. With reference to financing mix, the term hedging refers to ‘a process of matching maturities of debt with the maturities of financial needs’. According to this strategy, the maturity of sources of funds should match the nature of assets to be financed. This approach is, therefore, also known as ‘matching strategy’. This approach classifies the requirements of total working capital into two categories:

- Permanent or fixed working capital which is the minimum amount required to carry out the normal business operations. It does not vary over time.

- Temporary or seasonal working capital which is required to meet special exigencies. It fluctuates over time.

The hedging strategy suggests that the permanent working capital requirements should be financed with funds from long-term sources while the temporary or seasonal working capital requirements should be financed with short-term funds. This is a meticulous strategy of financing the working capital with moderate risk and profitability. In this strategy, each of the assets would be financed by a debt instrument of almost the same maturity. It means if the asset is maturing after 30 days, the payment of the debt which has financed it will also have its due date of payment after almost 30 days. Hedging strategy works on the cardinal principle of financing i.e. utilizing long-term sources for financing long-term assets i.e. fixed assets and a part of permanent working capital and temporary working capital are financed by short-term sources of finance. In case of a growth firm, the amount of fixed assets and permanent current assets go on increasing with the passage of time but the volume of fluctuating current assets change with the change in production level. According to this approach, non-current assets should be financed by long-term financing and current assets by short-term financing. Therefore, under a moderate approach, businesses should use long-term financing to finance non-current assets and permanent working capital. The need for temporary working capital should be met by short-term financing.

The basic objective of this method of financing is that the permanent component of current assets, and fixed assets would be met with long-term funds and the short-term or seasonal variations in current assets would be financed with short-term debt. If the long-term funds are used for short-term needs of the firm, it can identify and take steps to correct the mismatch in financing. Efficient working capital management techniques are those that compress the operating cycle. The length of the operating cycle is equal to the sum of the lengths of the inventory period and the receivables period. Just-in-time inventory management technique reduces carrying costs by slashing the time that goods are parked as inventories. To shorten the receivables period without necessarily reducing the credit period, corporate can offer trade discounts for prompt payment. This strategy is also called as hedging approach.

1.1. Rationale Behind Hedging (Maturity Matching) Approach

Knowing why to apply maturity matching strategy is very important. It suggests financing permanent assets with long-term financing and temporary with short-term financing. Now let us suppose opposite situations and see. There can two such situations.

- Permanent Assets Financed With Short Term Financing: In this situation, the borrower has to renew or refinance the short term loan every time simply because the duration for which money is required is higher, say 3 years, than the available loan is of, say 6 months only. The firm needs to renew the loan 6 times. This firm is exposed to refinancing risk. If the lender for any reason denies for renewal, what will the firm do? In such a situation for paying off the loan, either the firm will sell the permanent assets which effectively means closing the business or file for bankruptcy.

- Temporary Assets Financed With Long Term Financing: In this situation, firstly, the borrower has to pay interest on long term loans for that period also when the loan is not getting utilized. Secondly, the interest rate of long-term loans is normally dearer to short term loans due to the concept of term premium. These two additional costs hit the profitability of the firm. After all the discussion, in situation A, we learned that costs may be low but the risk is too high and situation B concludes high with low risk. Situation A is not acceptable because of such a high risk and situation B hits the profitability which is the primary goal of doing business and basis of survival. Therefore, the hedging or matching maturity approach to finance is ideal for effective working capital management.

1.2. Advantages and Disadvantages of Hedging (Maturity Matching) Approach

Advantages of Maturity Matching or Hedging Approach to Working Capital Financing are;

- Optimum Level of Funds (Liquidity) : The funds remain on the balance sheet only till they are in use. As soon as they are not needed, they are paid. This is how the interest cost is optimized in this strategy. Interest is paid only for the amount and time for which money is used. There is no unutilized cash lying idle with the business.

- Savings on Interest Costs : When short-term requirements are not funded with long-term finances, the firm saves interest rate difference between long term and short term interest rates. It is already known that long-term interest rates are comparatively higher due to the concept of risk premium.

- No Risk of Refinancing and Interest Rate Fluctuations During Refinancing : Since the fundamental principle of finance is followed here i.e. long term asset to long-term finance and short term assets to short term finance, there are no risk of refinancing and the interest rate fluctuations during refinancing. This means that while renewing a loan if the market scenario changes, the rate of interest may also adversely change. Here, there is no problem of frequent refinancing.

Disadvantages of Maturity Matching or Hedging Approach to Working Capital Financing are;

- Difficult to Implement : It is one of the best strategies or ideal strategy but it is very difficult to implement. Exactly matching the maturity of assets with their source of finance is practically not possible. There is quite a lot of uncertainty on current asset’s side. One cannot exactly predict at what time, the debtor will pay or what time the sales will occur. Once the credit is extended, the ball goes in the court of the debtor.

- Risks Still Persist : After adopting this strategy and planning everything in accordance with it, if the assets are not realized on time, it will not be possible to extend the loan due dates unreasonably. In that situation, the strategy moves either towards conservative or aggressive approach. Once that happens, the analytics and risks of those strategies will apply. The risks which are avoided with this strategy again come into play.

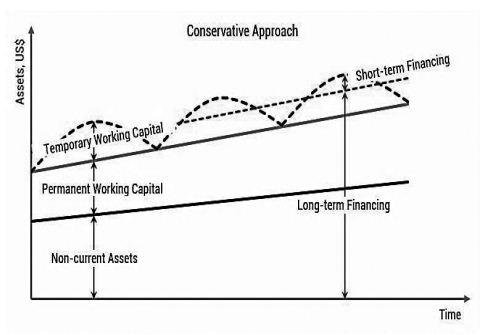

2. Conservative Approach to Working Capital Management

As the name suggests, it is a conservative strategy of financing the working capital with low risk and low profitability. In this strategy, apart from the fixed assets and permanent current assets, a part of temporary working capital is also financed by long-term financing sources. It has the lowest liquidity risk at the cost of higher interest outlay. This is the lowest risk working capital strategy and fails to ensure optimum utilization of funds. Hence it cuts down the expected returns of the shareholders. This strategy is illustrated in the following Figure.

Under a conservative approach, even a portion of temporary working capital is covered by long-term financing, and only an emerging need for funds is met by short-term financing. It also happens that businesses have an excessive cash balance, which should be invested in marketable securities. Such investments are able to be sold at any time to cover the emerging need for working capital.

- Long-term financing = Non-current Assets + Permanent Working Capital + Part of Temporary Working Capital

- Short-term financing = Part of Temporary Working Capital

This strategy suggests that the entire estimated investments in current assets should be financed from long-term sources and the short-term sources should be used only for emergency requirements. The distinct features of this strategy are:

- Liquidity is severally greater;

- Risk is minimized; and

- The cost of financing is relatively more as interest has to be paid even on seasonal requirements for the entire period.

2.1. Advantages and Disadvantages of Conservative Approach

The advantages of a conservative strategy are the lowest reinvestment and interest rate risk among the other working capital financing strategies. Moreover, it results in a higher level of liquidity and solvency, so such businesses can easily access short-term borrowing to cover emerging needs in working capital. Lowest risk, however, also results in lowest profitability because long-term financing usually has a higher cost than short-term financing. Funding temporary working capital by long-term financing also leads to the fact that businesses have interest expenses even when they do not have any need for temporary working capital. Under this strategy some part of fluctuating current assets is financed through short-term sources.

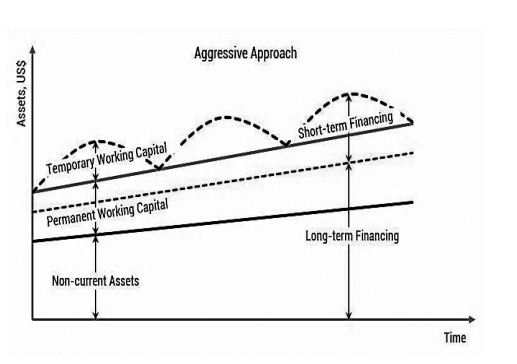

3. Aggressive Approach to Working Capital Management

This strategy is the most aggressive strategy out of all the three. The complete focus of the strategy is in profitability. It is a high-risk high profitability strategy. Fluctuating as well as permanent current assets under this strategy will be financed through short-term debt. In this strategy debt is collected on time and payments to the creditors are made as late as possible. It saves the interest cost at the cost of high risk. This strategy has been illustrated in the following Figure.

It doesn’t assume to hold any reserves to cover spontaneous needs in working capital. It means that only some portion of permanent working capital is financed by long-term financing. The rest and the temporary working capital, including seasonal fluctuations, are met by short-term borrowing. Adopting this approach makes it possible to reduce interest expense and increase profitability of a business, but it also carries the greatest risk.

- Long-term Financing = Non-current Assets + Portion of Permanent Working Capital

- Short-term Financing = Portion of Permanent Working Capital + Temporary Working Capital

Under this strategy current assets are maintained just to meet the current liabilities without keeping any cushion for the variations in working capital needs. The core working capital is financed by long-term sources of capital, and seasonal variations are met through short-term borrowings. Adoption of this strategy will minimize the investment in net working capital and ultimately it lowers the cost of financing working capital.

The companies working capital is financed by long-term source of capital and seasonal variation are met through short-term borrowing. Adoption of this strategy will minimize the investment in net working capital and ultimately it lowers the cost of financing working capital needs. The main drawback of this strategy is that it necessitates frequent financing and also increase, as the firm is variable to sudden shocks.

3.1. Advantages and Disadvantages of Aggressive Approach

The main drawbacks of this strategy are that it necessitates frequent financing and also increases the risk as the firm is vulnerable to sudden shocks. A conservative current asset financing strategy would go for more long-term finance which reduces the risk of uncertainty associated with frequent refinancing. Another drawback of an aggressive strategy is that businesses need to access short-term borrowing frequently to recover both the portion of permanent working capital and temporary working capital. As a result, the exposure to refinancing risk increases sharply and businesses become vulnerable to any interruption in accessing short-term borrowing.

The price of this strategy is higher financing costs since long-term rates will normally exceed short term rates. But when aggressive strategy is adopted, sometimes the firm runs into mismatches and defaults. It is the cardinal principle of corporate finance that long-term assets should be financed by long-term sources and short-term assets by a mix of long and short-term sources. This strategy makes the finance-mix more risky, less costly and more profitable. The advantage of this working capital financing strategy is that short-term financing is mostly cheaper compared with long-term financing, which allows a reduction in interest expense. Such an approach, however, violates the matching principle, which states that non-current assets and permanent working capital should be financed by long-term financing. Risk preferences of management shall decide the approach to be adopted. The risk neutral will adopt the hedging approach, the risk averse will adopt the conservative strategy and risk seekers will adopt the aggressive strategy.

Zero Strategy of Working Capital Management

This is one of the latest trends in working capital management. The idea is to have zero working capital i.e., at all times the current assets shall equal the current liabilities. Excess investment in current assets is avoided and firm meets its current liabilities out of the matching current assets. As current ratio is 1 and the quick ratio below 1, there may be apprehensions about the liquidity, but if all current assets are performing and are accounted at their realizable values, these fears are misplaced. The firm saves opportunity cost on excess investments in current assets and as bank cash credit limits are linked to the inventory levels, interest costs are also saved. There would be a self-imposed financial discipline on the firm to manage their activities within their current liabilities and current assets and there may not be a tendency to over borrow or divert funds. Zero working capital also ensure a smooth and uninterrupted working capital cycle, and it would pressure the Finance Managers to improve the quality of the current assets at all times, to keep them 100% realizable. There would also be a constant displacement in the current liabilities and the possibility of having over-dues may diminish. The tendency to postpone current liability payments has to be curbed and working capital always maintained at zero. Zero working capital would call for a fine balancing act in Financial Management, and the success in this endeavor would get reflected in healthier bottom lines.

Total Current Assets = Total Current Liabilities or Total Current Assets – Total Current Liabilities = Zero