First, it is necessary to understand why the field of cross-cultural differences is vital to business interactions. In many situations, it is beneficial for companies to merge. Some businesses are failing to perform on their own, but still possess resources that may be valuable for businesses in the same sphere. Other companies aim to expand to increase their growth and support the rising demand for their services. Overall, joint ventures and alliances happen to raise the value of the merging entities, whether this value is connected to the brands presence, technologies and other resources or economies’ scaling. Cross-border acquisition and merger can be motivated by these factors as well – companies often want to enter new markets, for which international collaboration is essential. Its unique challenge, however, is that the market the foreign company is entering is completely new to it in many aspects.

Merger and acquisition (M&A) are processes that impact all levels of the organisations, including its top management, other employees, processes, resources and clients. Two primary elements of such integration are considered – organisational and human. Both sides of M&A have to be analysed as they oversee the merger in processes and human resources, respectively. First of all, organisational integration is a part of the M&A operations that deal with most of the business-focused activities. These are production methods, facilities and staff management and others. When measuring the speed of the integration according to organisational principles and needs of merging companies, managers believe that all mergers have to happen quickly to lower the resistance of the workers and streamline the processes without sufficient losses. Arguably, this part of the mergers is the most researched by managers initiating an integration, as it contains the core aim of the M&A processes – the reconfiguration of resources to increase profit. Nonetheless , it is not the only aspect of acquisitions that has to be utilized in planning. The second part of the M&A is human integration, which is concerned with people affected by an M&A. In this case, various human resource management (HRM) strategies become the center of all plan. For instance, while organisational integration proposes an aim that the production has to be streamlined, human integration investigates this goal and concludes that management replacements may be necessary to achieve it.

A major factor of human integration that determines companies’ essence and impacts all internal and external processes is culture. Culture is a set of practices, values, standards, assumptions and beliefs that each firm develops over time and maintains. The elements of corporate culture are incorporated into the business’ objectives, mission and vision, employee behavior and hierarchy. Thus, culture is a complex ideology that brings meaning to each action in a company, being implicitly present in every element. It may be challenging for people inside a cultural environment to recognize its unique features as, to them, each process and idea are inherent and standard. The culture is also resilient to change, as it is usually formed over time with the growth and evolution of the business. Arguably, the two presented points – the implicit and resilient nature of culture – are vital for cross-cultural mergers. The ability to recognize cultural influences and use this knowledge to change the status quo in order to combine two different entities together is a process necessary for any merger.

It is also vital to understand what aspects of business culture can influence. First, culture determines the place of the hierarchical structures and decision-making styles in a firm – rigid level and title distinction and flat hierarchies with informal communication as well as clearly defined leadership figures or egalitarian structures. Second, the preparedness of the management and workers to risk is also determined by culture.

Teamwork and role definition are parts of another aspect – people may focus on individual achievement and internal competition or prioritize a larger collective goal. Finally, this description of people’s collaboration also influences how people define success – as something that one achieved alone or people completed together. As one can see, these characteristics can lead to absolutely different values, which reveals the number of cross-cultural issues that may occur during a merger.

Another vital aspect of any corporate culture is its national background. Each country possesses a set of values that it deems the best due to historical reasons. These beliefs are ingrained in business behavior as well – as a result, companies differ in their core philosophies, depending on the location of their creation and development. Thus, human integration has to include cultural implications in all goals that the merging companies aim to achieve.

It is now widely recognized that different philosophies and values of employees and businesses can determine the success of an M&A. For instance, there exists a link connecting the cultural distance between companies and their success of a cross-border acquisition. Cultural distance is the existence of differences in the norms, routines and repertoires for organisational design, new product development, and other aspects of management in the companies’ countries of origin. The more values and characteristics of the nations vary, the more culturally distant their firms are from one another. Thus, that businesses with distant cultures that are also not experienced in mergers are less likely to benefit from cross-cultural integration due to the lack of awareness about the values of another company. The term that represents a conflict between organisations’ core beliefs is a cultural mismatch. The factors of cultural distance and mismatch can be, therefore, used to analyse each merger in particular.

Another aspect of M&As that may be impacted by cultural distance is equity participation. Equity participation refers to the percentage of equity in the target firm that the acquiring firm obtains after the CBA [cross-border acquisition] transaction. Higher equity participation results in more control over the acquired firm, but find that firms often compensate for the cultural distance by acquiring more equity. This finding suggests that, during cross-border integration, power plays a significant role, and merging businesses choose to impose control through owning a more substantial part of the integrating firm.

The role of cultural integration is identified as a foundation of successful M&As. This process allows for better social control, which, in turn, leads to effective governance. It should be noted that the major portion of all activities related to social control happens post-acquisition. Employees of the target and acquiring firms have to interact closely after the merger has been put in action, and this is the point in time when their unique cultural aspects show themselves fully. This is the stage at which a merger can fail not just due to financial or manufacturing problems, but also due to human-related behavioral issues.

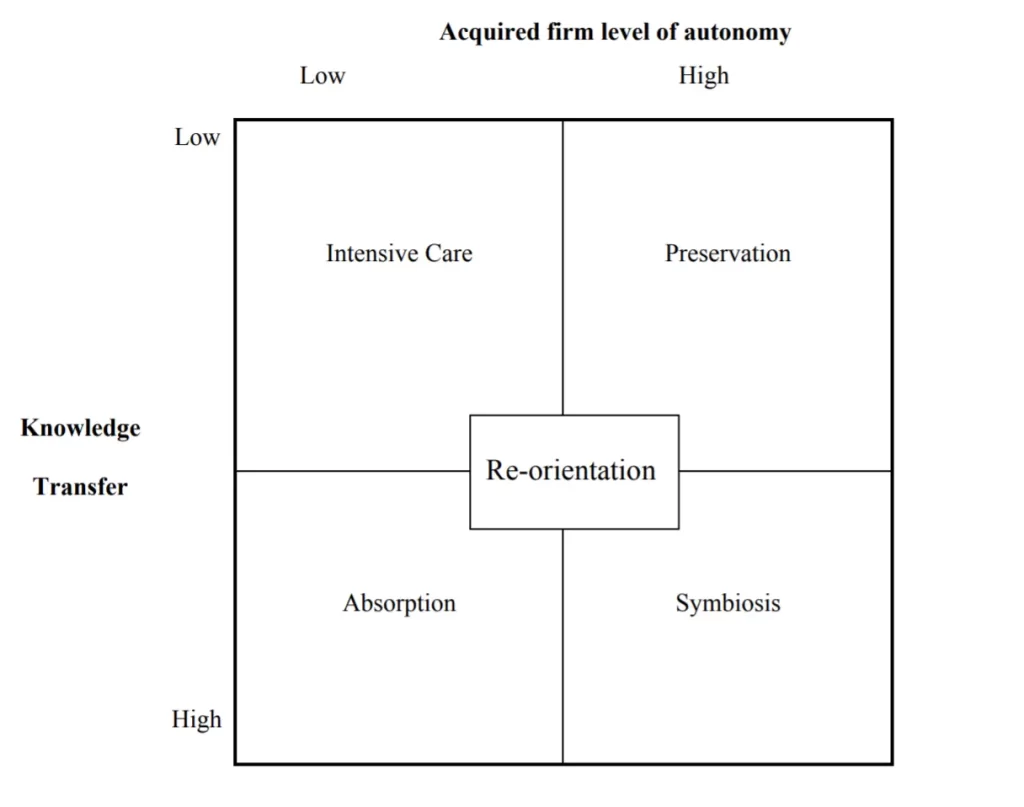

Thus, when discussing sociocultural perspectives, most experts center their attention on post-acquisition strategies. The stage of post-acquisition is the primary source for value creation during the M&A process. Thus, apart from the reasons for the merger, managers have to consider the cultural characteristics of the company they are working at and the one they aim to integrate. Nonetheless, this statement does not mean that companies have to act according to one type of M&A cultural integration. In fact, Angwin and Meadows (2015) propose a set of five main styles which organisations use most often. These models of integration depend on firms’ knowledge transfer and autonomy levels preserved by the acquired businesses.

The matrix of the five styles is based on the companies’ different approaches to information sharing and autonomy preservation. For cases, where acquirers do not integrate any new technology or processes into the newly added company, while also significantly changing its government structure and assuming control over organisational and financial spheres, the authors propose a name “Intensive Care”. “Preservation” refers to situations, in which the acquiring and the acquired firms do not exchange knowledge or influence each other’s autonomy. The third and fourth styles refer to businesses that engage in knowledge transfer by sharing technology, workers, experience, and process details. Here, “Absorption” resembles a full integration of the acquired company in accordance with the standards of the leader and stakeholder. In contrast, “Symbiosis” refers to the relationship of integration with retention of personal differences and unique cultures. Finally, the authors propose a new style, “Re-orientation” which present a balanced model for moderate knowledge transfer and a degree of autonomy.

The strategies demonstrate that each firm can determine which actions it needs to take, depending on the internal corporate situation and the outcomes it wishes to achieve. It is apparent that such styles as absorption are chosen by companies with a robust and overpowering culture that has to be maintained by acquired entities to be entirely accepted and supported. In contrast, preservation describes the way of the least visible intervention, where the acquiring company does not share its information, while also not putting restrictions on the obtained business. Interestingly, the fifth style, re-orientation, which is placed in the center of all actions. It represents a new strategy that does not accept extremes in both governance and knowledge transfer, focusing on partial integration on higher levels of management and leaving a significant level of autonomy. This strategy may be the most effective in many cases where cultural mismatch is a serious issue. The application of these styles in the analysis is crucial for understanding which approaches were the most effective in the discussed cases and why.

All strategies for post-acquisition integration consider knowledge transfer and autonomy as the main characteristics of the M&A style. The former of these aspects plays a significant role in the merger’s success – the higher the level of knowledge transfer, the better the outcome of the acquisition. Nonetheless, cultural distance negatively affects cross-border integrations, but organisational culture has the potential in mediating these conflicts and supporting knowledge exchange. These conclusions raise the question of whether specific sociocultural techniques in post-integration activities can raise the chance of positive merger outcomes. According to the knowledge-based approach, these techniques include the reduction of causal ambiguity, cultural knowledge sharing, leader effectiveness and motivation and early target involvement. Thus, clear goals, strong leadership, and cultural and informational openness are proposed as the basis for a successful merger.