In the late 1980s, Jensen (1987) introduced the free cash flow theory to explain the financial decisions of managers in investing surplus money (excess cash flow). The free cash flow theory stems from the availability of corporate funds, after the deduction of all expenses. Managers often use this fund for purposes of expanding their businesses or paying out dividends to their shareholders. However, studies shows that many managers prefer to use this excess cash to enter into merger and acquisition agreements. Their incentive may be higher profitability and business advantages that mergers and acquisitions offer (compared to other investments). Occasionally, despite the failure of some investments to increase shareholder value, managers may decide to use these funds to expand businesses (through these mergers and acquisitions). They often prefer this option because the second alternative of paying out dividends to shareholders leads to the loss of financial resources and managerial power. The option of pursuing mergers and acquisitions is therefore emerging as an attractive option for most managers because it expands the pool of resources that would be under their control.

The free cash flow theory plays a useful role in understanding the impact of mergers and acquisitions of different organizations because it shows which mergers or acquisitions are likely to fail, and which one would possibly succeed. The free cash flow theory also helps to highlight the nature and solutions of conflicts between shareholders and managers. For example, a common conflict between shareholders and managers is how to spend their excess cash (acquisitions or dividends?). Here, the free cash theory predicts that most managers are likely to undertake projects that have a low benefit to the organization (acquisitions). The same theory also shows that most managers are likely to participate in mergers that are likely to destroy the value of their firms. For example, diversification is an obvious choice for many managers. However, it does not generate any immediate gains for organizations.

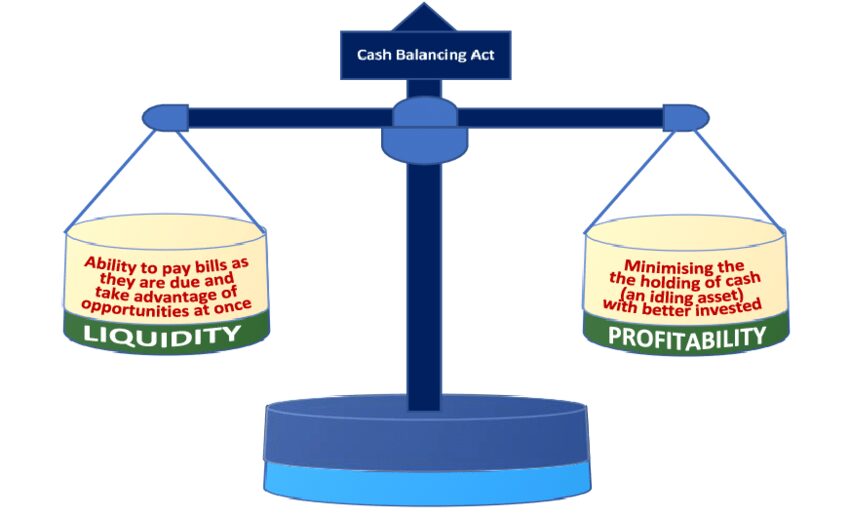

Nonetheless, the main advantage of such strategies is the possibility of future gains, as opposed to the option of investing the same money in unprofitable ventures within the organization. Comparatively, acquisitions (made without stock options) often provide additional benefits to shareholders because it increases the pool of resources under their control. This view is true even when such acquisitions create inefficiencies within the organization. Comprehensively, the free cash flow theory outlines a critical cash-balancing act that wavers between profitability and liquidity needs. As shown through the diagram below, managers face two real options of meeting current liquidity needs (paying bills) and investing excess cash to increase profitability (minimizing holding cash) by exploiting business opportunities to increase the company’s future liquidity (the latter option often involves pursuing merger and acquisition transactions).

Managers who handle huge cash flows often pursue the latter option by preferring to pursue future profitability needs, as opposed to short-term liquidity needs. Declining industries offer a new dynamic to the above analysis because research shows that most mergers that occur within the industry create value, but those that do not occur within the industry create lower values, or, sometimes, no value at all. Firms that operate in the tobacco and energy sectors demonstrate this fact. For example, most tobacco-manufacturing firms lose revenue because of changing consumer habits (but they still enjoy free cash flows that allow them to participate in several acquisition ventures). Most of these firms enjoy excess cash flow but provide very little opportunity for growth.

These characteristics mean that such companies are good targets for leveraged buyouts. One such example is the $6.3 billion Beatrice LBO merger, which generated excess cash flow through rent, but was limited by existing regulations to expand. Because of limited internal investment opportunities, the organization participated in many diverse programs. Overall, the free cash flow theory mainly applies to industries where companies have excess cash flows, but the breakdown of internal policy frameworks, or market limitations, stifle their opportunities for growth. The theory predicts that takeovers occur in such circumstances. The theory also predicts the dismantlement of businesses that do not enjoy large economies of scale.