Brief History of the Company Strip away the outer covering of Valeant Pharmaceuticals and find a business enterprise that started its profit-making in the decade of the 1960s. One can argue that it started as an obscure organization focused on understanding the business side of the specialty chemical research enterprise. However, the company started to gain global attention at the turn of the 21st century when its corporate leaders initiated a series of mergers and acquisitions. In the present time, the said pharmaceutical company sells a variety of drugs, such as over the counter medication and prescription drugs. The company’s radical assent into the top of Wall Street’s list of the favorable company started in earnest when it hired Michael Pearson as the new CEO of Valeant Pharmaceuticals. He orchestrated a series of major mergers and acquisitions that required the use of billions of dollars in resource allocation to take control Continue reading

Business Ethics Case Studies

Case Study: History of British Petroleum and Deepwater Horizon Oil Spill

The history of British Petroleum (BP) is inextricably linked to innovative environmental projects aimed at changing the activities of the entire global industry. Back at the end of the 20th century, the corporation announced a program to transform the production of petroleum products in accordance with the principles of environmental protection. The campaign was called “More Than Oil” and implied the expansion of alternative energy production facilities, including the expansion of solar energy production. This policy cost the management team a large investment of over a hundred million dollars and, by the beginning of the 21st century, brought significant reputational benefits. British Petroleum became the most popular and respected supplier of petroleum products to various countries around the world. However, while actively expanding its oil fields, management encountered the first global problems, which served as the starting point for many environmental catastrophic events in the history of British Petroleum. In Continue reading

Case Study on Business Ethics: Olympus Corporation Financial Statement Fraud

Olympus is a Japanese company that specializes in medical imaging tools and photo/video cameras. Back in the 1980s, when the operating income of the company decreased due to the sharp appreciation of the yen, the Olympus executives started an aggressive financial assets management in order to shift losses off the company’s balance sheet. As a result, Olympus has managed to hide $1.7 billion of investment losses for more than a decade. The case of Olympus is the example of the financial statement fraud in which an employee intentionally causes a misstatement or omission of material information in the organization’s financial reports that eventually results in median loss of $1 million. To conceal the losses, the company has developed a tobashi scheme in which they booked the company’s assets at historical cost instead of fair market value. In 1997, the Japanese legislation was reformed, and since then all the assets should Continue reading

Case Study on Business Ethics: Examining Enron Corporation’s Business Failure

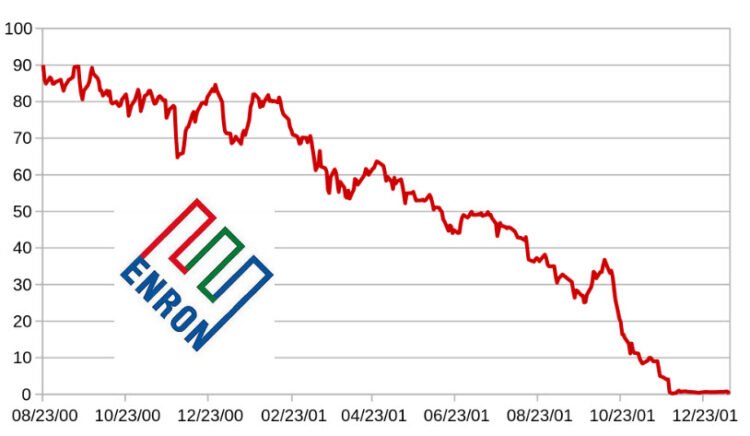

The case of Enron Corporation was one of the most vivid examples of accounting errors and unethical behavior followed by the company’s management. This case had a great impact on other companies and auditing and reporting standards and procedures. After the collapse of the energy company Enron in January 2002, financial statements seem a lot less hard and objective than they once did. Enron caused many problems occurred among equity shareholders, as a company with an equity market capitalization of over $70 billion became worthless in just over a year. The Enron fiasco focused attention on US accounting practices, and highlighted the relationship between companies and the accounting firms who as auditors were meant to confirm the accuracy of financial statements. For many years corporate governance experts had worried over potential conflicts of interest when accounting firms acted as both consultants and auditors to the same firm, but these conflicts Continue reading

Case Study: Ahold Company’s Downfall and It’s Causes

Cess van Der Hoeven, Ahold’s CEO, set ambitious expansion targets for the company in 1994. Sales were expected to double every five years. A similar target was set for net profit. This plan would ensure a 15% compound growth in both sales and net profits per annum. Such an expansion called for investment funds. 66.7% of the expansion was to be funded by the company’s cash-flow. The remaining 33.3% was to be funded by external creditors. The earnings Per Share was to grow at 10% annually. Ahold managed to acquire the Stop and Shop chain thus rising to be the 5th largest food retailer in the world. Van Der Hoeven set a target for the company to be the 2nd largest food retailer. This meant overtaking Carrefour, to rank after Wal-Mart. Ahold expanded rapidly between 1994 and 1999 through the acquisition of several supermarkets globally. Initially, the company focused on purchasing regional Continue reading

Case Study on Business Ethics: Analysis of the Downfall of WorldCom

WorldCom Downfall – Failure to Live up to its Mission Statement WorldCom was a global telecommunication company that, at some point, grew to become the second-largest phone company offering long-distance services. Its mission statement read that “Our objective is to be the most profitable, single-source provider of communications services to customers around the world”. Moreover, the company’s supplier diversity mission statement was defined as to “Create a competitive advantage for WorldCom and contribute significantly to WorldCom’s business success by promoting business practices that provide greater opportunity for a diverse supplier base”. The company, after witnessing a period of growth propelled by various successful acquisitions and mergers, became bankrupt with a damaged image due to its accounting malpractices. It filed for bankruptcy protection on July 21, 2002 before transforming its name to MCI and relocating its corporate headquarters to Dulles, Virginia, from its previous location in Jacksonville, Mississippi. The accounting malpractices Continue reading