Google Inc. started two decades ago as a Silicon Valley startup with an innovative way of accessing the Internet. The company is headquartered in Mountain View, CA, and came into the business world in 1997, one year after it was established with its shares offered to the public in 2004 in the most unusual online way. Currently, Google is one of the search engines that are frequently used around the world, which has enabled the company to further raise its market share. The main product of Google is the search engine, which has enabled it to have global dominance. In addition, the company has other products such as Google Maps., Chrome Browser, Google Drive, YouTube, Play Store, Gmail, and the Android operating system. However, it is worth noting most of the above-named products are offered free of charge to Google users, but customers have to pay to access premium product features. Continue reading

Business Ethics Case Studies

Case Study: Analysis of the Ethical Behavior of Coca Cola

Coca-Cola is the world’s largest beverage company that operates the largest distribution system in the world. This allows Coca-Cola companies to serve more than 1 billion of its products to customers each day. The marketing strategy for Coca-Cola promotes products from four out of the five top selling soft drinks to earn sales such as Coke, Diet Coke, Fanta and Sprite. This process builds strong customer relationships, which gives the opportunity for these businesses to be identified and satisfied. With that being said, customers will be more willing to help Coca-Cola produce and grow. Pepsi and Coca-Cola, between them, hold the dominant share of the world market. Even though Coca-Cola produces and sells big across the United States, in order for the company to expand and grow, they had to build their global soft drink market by selling to customers internationally. For example, both companies continued to target international markets Continue reading

Business Ethics Case Study: Caterpillar Tax Fraud Scandal

Accounting fraud is the manipulation of financial statements in order to benefit the business financially or to create a false appearance of financial health. In the situation of Caterpillar Inc. (CAT) – a manufacturer of heavy construction and mining equipment, diesel-electric locomotives, diesel, and natural gas engines, and industrial gas turbines – the payment of federal income taxes on their earnings was avoided to boost the company’s financial status, saving the company billions of dollars and keeping its stock price high. CAT, having more than 500 locations worldwide – including the Americas, Asia Pacific, Europe, Africa, and the Middle East – is vast in size and an economic standpoint, with sales and revenues of $53.9 billion in the year 2019. However, a lawsuit against Caterpillar Inc. for inadequate tax disclosure had greatly impacted the company from the time period of 2013 to 2017. A great portion of Caterpillar Inc.’s investigation Continue reading

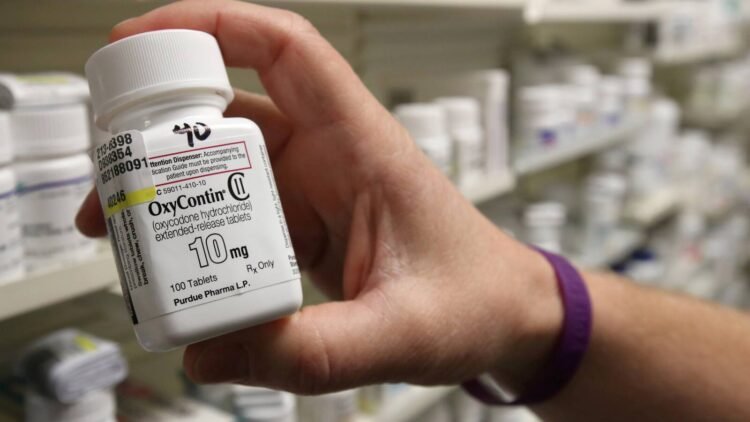

Case Study on Business Ethics: McKinsey Opioid Scandal

McKinsey and Company, a leading consulting agency, has agreed to pay US$573 as a settlement for advising Purdue Pharma, a drug company, on how to “supercharge” opioid sales. The agreement to pay the settlement was reached after the management of the consultation firm agreed with attorney generals of 47 states, Massachusetts court records revealed. This action disrespects human rights, especially for the patients of the drug produced by Purdue Pharma. The decision to settle was made in February 2021 when the Company’s unethical advice to the pharmaceutical organization was disclosed. For about a decade, McKinsey advised Purdue on ways to brand and market opioids and influence doctors into prescribing high doses of opioids. The consulting firm also ensured that Purdue maximized its profits by offering guidance on evading pharmaceutical prescriptions. In addition, McKinsey was also known to be involved with other opioid-related works, including consulting advice to Johnson & Johnson, Continue reading

Case Study on Business Ethics: The Wells Fargo Fake Accounts Scandal

Wells Fargo, one of the largest and most profitable banks in America, struggles to repair its dented image after it was caught in a mega fraudulent accounts scandal. The San Francisco-based bank had its management pressure on its employees to meet unrealistic sales targets, which led to the fake account incident. The customers were forced to pay bank charges they did not know about, and it was much later that the scandal was unraveled. Between 2011 and 2015, more than 1.5 million accounts were opened by Wells Fargo employees, and 565,000 credit cards were applied in customer’s names without their authorization. During a lawsuit by the government regulatory bodies, the Securities and Exchange Commission (SEC), the Department of Justice (DOJ), and the Federal Reserve, it was established that Wells Fargo blatantly falsified its bank records. Apart from the hefty fines that have been imposed on Wells Fargo, there are lessons Continue reading

Case Study on Corporate Governance: WorldCom Scandal

Established in 1988, WorldCom was formed so that the strongest, most capable public relations firms could serve national and international clients, while retaining flexibility and client- service focus inherent in independent agencies. Through WorldCom, clients have on demand access to in-depth communication expertise from professionals who understand the language, culture and customs in the geographic areas of operation. WorldCom has 105 offices in 90 cities and 40 countries on five continents, more than 2000 employees and recorded revenue of US $ 243.5 million in 2008. In the 90’s WorldCom was involved in acquisitions and purchased over 60 firms. The complete financial integration of the acquired company must be accomplished, including an accounting of assets, debts, and a host of other financially important factors. WorldCom moved into Internet Traffic, controlling 50% of US Internet Traffic and 50% of the e-mails worldwide. In 1997, WorldCom and MCI completed a US $37 billion Continue reading