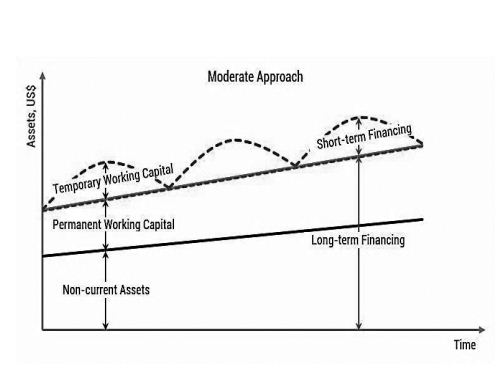

Working capital is said to be the life blood of a business. Working capital signifies funds required for day-to-day operation of the firm. In financial literature, there exist two concepts of working capital namely: gross and net. Accordingly, gross concept working capital refers to current assets viz: cash, marketable securities, inventories of raw materials, work-in-process, finished goods and receivables. According to net concept, working capital refers to the difference between current assets and current liabilities. Ordinarily, working capital can be classified into fixed or permanent and variable or fluctuating parts. The minimum level of investment in current assets regularly employed in business is called fixed or permanent working capital and the extra working capital needed to support the changing business activities is called variable or fluctuating working capital. There are broadly 3 working capital management strategies/ approaches to choose the mix of long and short-term funds for financing the net working Continue reading

Business Finance Concepts

Accounts Payable – Meaning, Process, Advantages, and Disadvantages

Every business owner would like to have all sales on a cash basis, but that’s not always possible in a competitive marketplace. Sometimes, sellers need to offer sales on credit terms just to get customers to buy their products. Unfortunately, selling on delayed payment terms opens up an entirely new aspect of running a business: managing the extension of trade credit to customers. constitute a current or short term liability representing the buyer’s obligation to pay a certain amount on a date in the near future for value of goods or services received. They are short term deferments of cash payments that the buyer of goods and services is allowed by the seller. Payables is extended in connection with goods purchased for resale or for processing and resale, and hence excludes consumer credit provided to individuals for purchasing goods for ultimate use and installment credit provided for purchase of equipment Continue reading

Liquidity and Profitability Trade-Off

Differences Between Liquidity and Profitability The liquidity is the ability of a firm to pay its short term obligation for the continuous operation. A firm is considered normally financially solid and low risky which has huge cash in its balance sheet. The liquidity is not only measured by the cash balance but also by all kind of assets which can be converted to cash within one year without losing their value. It has primary importance for the survival of a firm both in short term and long term whereas the profitability has secondary important. The profitability measures the economic success of the firm irrespective to cash flow in the firm. It is often observed that a firm is very profitable in its books but it does not have sufficient cash and cash equivalent to pay its daily bills and due obligations. That is an illustration of classical poor liquidity management. Continue reading

Difference Between Foreign Direct Investment (FDI) and Foreign Portfolio Investment (FPI)

Foreign Direct Investment (FDI) and Foreign Portfolio Investment (FPI) are the two most important terms of the market. The major difference between the two could be explained as one takes the form of investment and other financing. They are usually adopted by most developing countries. The measurement criteria for both the terms lie in the capital contribution made in the particular company or market. The most advantageous thing is the ignorance of debt creation. This is why these terms are preferred than External Commercial Borrowings which creates a debt trap for most of the countries. Foreign Direct Investment (FDI) could be defined as an investment by non-residents mostly the business entities to establish business operations in a country with the proper management of equipment’s, machineries, marketing, personnel etc. In the established company the non-resident entity takes over a considerable stake to get the ownership rights and enjoys the management control Continue reading

Effects of Price Level Changes on ROI and RI

The price level changes are a common phenomenon and will introduce entirely new distortions into ROI and RI measures. The principal distortions occur because revenues and cash costs are measured at current prices, while the investment cost and depreciation charge are measured at historical prices used to acquire the assets. Depreciation based on historical cost underestimates what the depreciation charge would be based on the current cost. This results in overstating the firm’s income. At the same time, the firm’s investment is understated, because most of firm’s assets were acquired in precious years at lower price levels than those currently prevailing. The combination of overstated net income and understated investment causes the ROI or RI measures to be much higher than if inflation had not occurred. The increased ROI or RI is not a signal of higher profitability and it is mainly due to a Continue reading

Types of Finance Lease Agreements

A finance lease, also called a capital lease, is one which usually covers the full useful economic life of the assets or a period that is close to the economic life. The lessor receives lease rentals during the lease period so as to recover fully not only the cost of the assets but also a reasonable return on the funds used to buy the assets. The finance lease is usually a non-cancellable and the lessee provides for the maintenance of the assets. The lease payment under financial lease is a payment for the use of the assets only and the responsibility for the repair and maintenance of the assets generally lies with the lessee. Since the term of a finance lease is normally closely aligned with the economic life of the assets, the lessee’s position is quite similar that of an owner; and the cost of maintaining is in its Continue reading