Nowadays due to technology advancement, the way of how businesses were conducted has evolved to be more globally attributed and dependable to technological innovation aids. Furthermore, technology could help a firm to be sustained by having competitive advantage, and this especially true in the situation of where firm had the strong dependency towards technology innovation. Technology had becomes more important to specific firm or business when it has the ability to significantly affect their competitive advantage or industry structure. Thus, it is important for firms to choose and execute their strategy systematically to stay competitive and sustainable in the market. There are 3 ways of how first-mover could achieve their advantages. The first sources of how first-mover competitive advantage could be triggered are (i) technological leadership, (ii) preemption of assets, and (iii) buyer switching cost. Technological leadership will benefit first-mover in term of leadership in innovation, which ensure the sustainability Continue reading

Business Strategies

Case Study: The Strategic Alliance of Fiat And Chrysler

Corporations, firms, and companies implement stringent measures to improve operations during periods of severe financial constraints. Many livelihoods depend on their stability and it would be unethical to fail to take action. In addition, it is necessary to protect the investments and interests of stakeholders who would be affected if the businesses collapsed. Therefore, it is crucial for organizations and companies to take necessary steps to safeguard interests of stakeholders. The 2009 strategic alliance between Chrysler and Fiat was a bold move towards saving Chrysler, a company that had operated for many years. The merger was a major setback for Chrysler to a certain degree. Chrysler lost a lot of money when it allowed Daimler to relinquish its portion of the company to Cerberus because the offer price was less than a quarter of the initial capital. However, the merger saved Chrysler because it was in a financial crisis that Continue reading

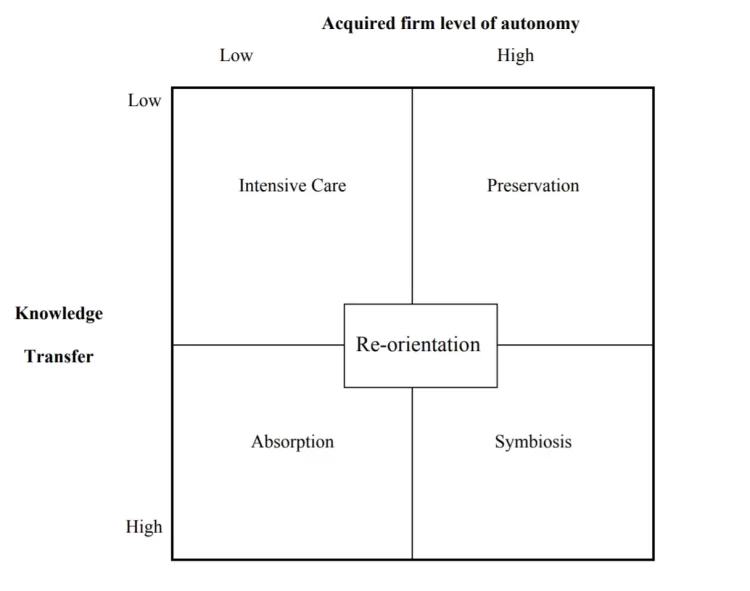

Cultural Integration in Mergers and Acquisitions

First, it is necessary to understand why the field of cross-cultural differences is vital to business interactions. In many situations, it is beneficial for companies to merge. Some businesses are failing to perform on their own, but still possess resources that may be valuable for businesses in the same sphere. Other companies aim to expand to increase their growth and support the rising demand for their services. Overall, joint ventures and alliances happen to raise the value of the merging entities, whether this value is connected to the brands presence, technologies and other resources or economies’ scaling. Cross-border acquisition and merger can be motivated by these factors as well – companies often want to enter new markets, for which international collaboration is essential. Its unique challenge, however, is that the market the foreign company is entering is completely new to it in many aspects. Merger and acquisition (M&A) are processes Continue reading

Growth and Success of an Enterprise – Factors and Stages

There exists several factors which contribute to the growth and success of an enterprise and among the leading factors is the age of the firm. To explain why smaller and younger firms are likely to grow faster than old and large enterprises is explained in economics by the use of the concavity of the production function. Where at the start, the small capital invested has the capability of multiplying exponentially but as time moves on and new investments are injected in to the investment, the marginal rate of productivity of the invested capital declines and that explains the reason why young firms grow faster than old and already established enterprises. Although many experts indicate that as the firm ages the likelihood of it learning form its mistakes and thus succeeding are high, the multiplier effect of large business is low and this is a major contributor to the success of an Continue reading

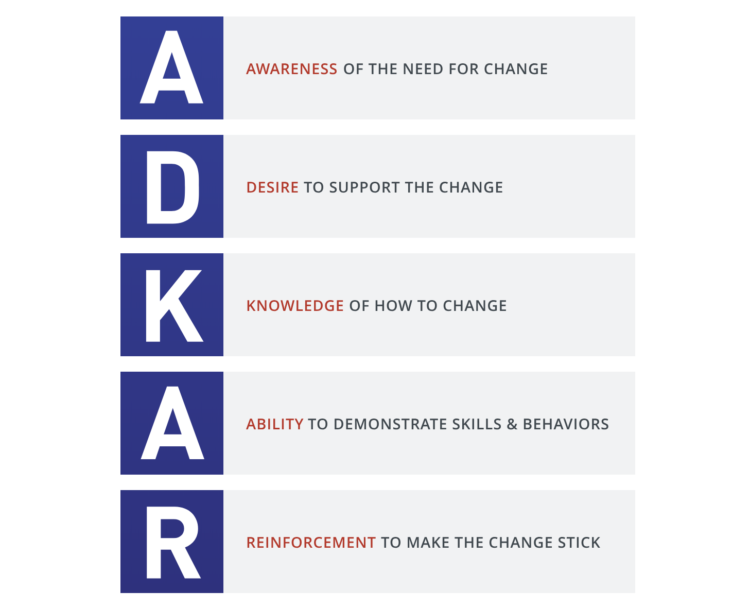

Advantages and Limitations of Prosci ADKAR Model

There are a number of models in management that aim to reduce resistance to change and control most organizational change processes. The Prosci ADKAR model is one of the best approaches introduced several years ago to support change in companies through the prism of its five major elements, namely awareness, desire, knowledge, ability, and reinforcement. The progress of the ADKAR model is evident today due to its evident advantages and the possibility to facilitate working processes. This model is developed from a study of 900 organizations across 59 countries over a 14-year period, carried out by the American research organization, Prosci. This model, developed by Jeff Hiatt, and first published in 2003, focuses on participatory approach of dealing with change. The model is simple to learn, makes sense, and focuses on the actions and outcomes required for change. ADKAR, in contrast to most other change management models, focuses on the human aspect Continue reading

Case Study: Why did EBay’s Acquisition of Skype become a Flop?

Acquisitions and mergers are organizational expansion frameworks that allow companies to gain control of more resources and grow their reach to diverse markets. An acquisition involves obtaining another organization’s shares or resources, and a merger refers to establishing an alliance with aligned goals while sustaining independence. Therefore, though creating a partnership and buying out other companies are effective growth strategies, they have different implications, target specific outcomes, require varying managerial approaches, and do not often succeed. For example, eBay’s acquisition of Skype in 2005 was one of the biggest business flops of the 21st century because they did not investigate the feasibility of their expansion strategy. Although eBay made a sound decision to purchase a fast-growing internet company, its initiatives did not yield fruits because it could not use Skype to enhance its business or facilitate efficiency. In the late 1995, Pierre Omidyar established “Auction Web”, as an online auction Continue reading