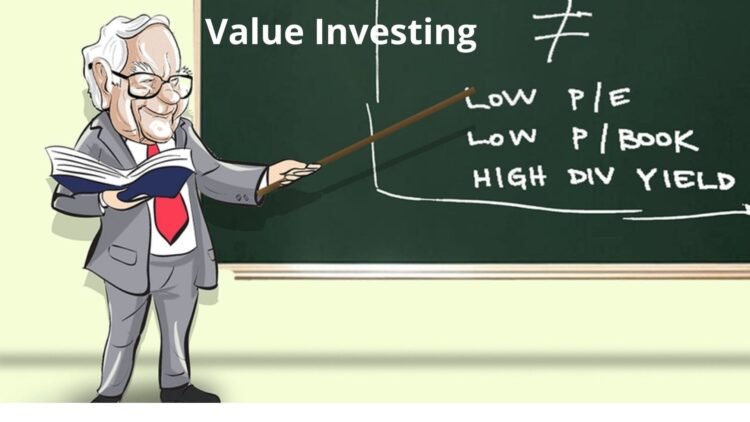

Value investing as a philosophy of investing started its evolution at the beginning of the twentieth century when Benjamin Graham started teaching this investing strategy in Columbia Business School in 1927. Later, in 1934, one of his students, David Dodd, published Graham’s lectures as Security Analysis that is considered to be a bible for value investors. Today, any investor who is keeping to this strategy may be referred to as Graham-and-Dodd investor. This philosophy has one attractive advantage – one does not need to be a finance genius to become a successful value investor; all he needs is money to invest, patience and time and desire to read some books and do some accounting. It gained popularity because of success of one of its most famous followers, Warren Buffett, who once said about it: ” The investment shown by the discounted-flows-of-cash calculation to be the cheapest is the one that the investor Continue reading

Corporate Finance Concepts

Private Equity Firms – Definition, History, Functions, and Advantages

A Private equity firm can be defined as a company that invest huge amounts of capital known as the private equity fund in the stakes of a private firms. In other words, private equity firms invest in classified equities of working companies through application of various investment strategies. From the definition, private equity means capital that is not traded in the stock exchange markets. In most cases, private equity firms raise private equity capital from institutional investors and devote the capital in public firms that face delisting from the stock exchange through buyouts. Private equity capital is normally used in the expansion of working capital of the acquired firm, make acquisitions, finance research and development as well as new technologies. In addition, the private equity capital can be invested in strengthening the balance sheet of an acquired company. As indicated, private equity firms are often institutional and recognized investors committed to Continue reading

What is Angel Investing? Concept, Benefits, and Disadvantages

Implementation of a viable business idea will normally require a great deal of capital and the ability of the entrepreneur to raise the necessary capital, the higher the chances of business success. Start ups are businesses at the initial stages and hence there are very limited sources of funds available to such businesses due to uncertainties surrounding their success. Start ups will therefore depend largely on the owner’s capital and contribution from friends. Credit facilities from financial institutions and other lenders will normally require collaterals and this limits the chances of new business owners to secure such findings. In recent times however, the entrepreneurs across the world have been able to get a lot of reprieve from venture capitalist that are willing to support a business idea to its implementation stages. A venture capital is a specialized form of funding that targets high risk high return investments with potential growth in Continue reading

What is Return on Investment (ROI)?

Return on Investment (ROI) refers to a well-known financial metric commonly used to analyze the financial results which arise from personal investments as well as deeds. A number of varying metrics are basically known by the same definition. Normally used as a cash flow metric, the Return on Investment particularly makes a comparison of the scale as well as scheduling of investment gains which are matched directly to the scale and scheduling of costs involved. In any situation where the ROI is seen to post a high rate, it implies that the gains which have been made compare well with the costs that had been incurred. Return on Investment (ROI) = (Net Profit or Gain / Cost of Investment) * 100 Return on Investment has grown into a well-known concept within the past few decades mostly as an all-purpose metric for analyzing capital attainments, business initiatives, and conservative fiscal investments. These Continue reading

Performance-Based Budgeting – Meaning, Working, Pros, and Cons

Performance-based budgeting has been the center of reforms in both the private and the public sectors. However, a substantial ambiguity still remains on how to define and implement performance-based budgeting. A somewhat close definition is that performance-based budgeting apportions resources in accordance with specific achievement or quantifiable results. Performance budgeting can also be defined as systems of planning, budgeting, and appraisal that focuses the link between budgeted funds and the expected outcome. Therefore, performance-based budgeting links measurable performance and allocation of resources, with the capacity to state the level of achievable output with the injection of additional resources. Nevertheless, the output can never be measured accurately. Performance budgeting is result oriented in that it holds different divisions accountable to specific performance standards. This form of budgeting enhances awareness of the kind of services expected by the taxpayer. This type of budgeting is flexible since it allocates resources in a lump sum Continue reading

Why Shareholder Wealth Maximization is Important in Business?

In modern finance, it is proven that shareholder wealth maximization is the superior goal of a firm and shareholders are the residual claimants; therefore maximizing shareholder returns usually implies that firms must also satisfy stakeholders such as customers, employees, suppliers, local communities, and the environment first. Also, a firm’s value can not be maximized if the management board or shareholders ignores the interest of its stakeholders. Thus, the main goal of a firm is to maximize shareholder wealth but it does not mean that management should disregard stakeholders. To begin with, it is necessary to understand what is shareholder wealth and why maximizing shareholder wealth is a superior objective? Maximizing shareholder wealth is defined as maximizing purchasing power as well as the flow of dividends to shareholders through time and it is a long-term perspective. In addition, a very important point to explain why shareholder wealth maximization is superior objective Continue reading