In recent years, the conditions of competition in the global environment have changed for the companies. The market is dominated by constant change, complex tasks and environmental turbulence. As knowledge, innovation and flexibility become an important resource for sustained competitive advantage and ‘Entrepreneurship’ is the crucial factor for success or survival. While small firms take the advantage of these conditions and become very successful due to their flexible structure and entrepreneurial spirit, large firms suffer more due to their mechanistic, bureaucratic and rigid structures. One of the solutions for companies to deal with the rigid bureaucratic structures is to induce Corporate Entrepreneurship in their structure. While CEOs are concerned about profitable organic growth, they find corporate entrepreneurship or creating a new business as one of the solution. As corporate entrepreneurship is becoming popular, it can be seen as a school within entrepreneurship theory. Since there is no generally accepted definition Continue reading

Corporate Strategies

Competitive Advantage of First Mover and Late Mover Strategies

Nowadays due to technology advancement, the way of how businesses were conducted has evolved to be more globally attributed and dependable to technological innovation aids. Furthermore, technology could help a firm to be sustained by having competitive advantage, and this especially true in the situation of where firm had the strong dependency towards technology innovation. Technology had becomes more important to specific firm or business when it has the ability to significantly affect their competitive advantage or industry structure. Thus, it is important for firms to choose and execute their strategy systematically to stay competitive and sustainable in the market. There are 3 ways of how first-mover could achieve their advantages. The first sources of how first-mover competitive advantage could be triggered are (i) technological leadership, (ii) preemption of assets, and (iii) buyer switching cost. Technological leadership will benefit first-mover in term of leadership in innovation, which ensure the sustainability Continue reading

Mergers and Acquisitions (M&A) – Definition, Types, and Process

Mergers and Acquisitions (M&A) are increasingly becoming a novel approach for companies to wade through the competitive pressures of today’s globalized society. The increase of mega-mergers in today’s corporate world demonstrates the entrenchment of such transactions in modern business practices. Definitions of Mergers and Acquisitions “One plus one equals three”. This statement defines the main logic that informs merger and acquisition transactions. This logic stems from the fact that most companies aim to create a bigger shareholder value than the sum of the shareholder value that would ordinarily be realized if two corporate entities merge. The reasoning behind merger and acquisition transactions therefore stems from the fact that there is a greater value when two companies work together, as opposed to two companies working in isolation. Mergers and Acquisitions (M&A) are therefore joint activities where the activities of two or more companies merge to create one common purpose for both Continue reading

Case Study: The Daimler Chrysler Failed Merger

In 1999, the Daimler Benz corporation of Germany merged with the Chrysler Corporation. In merging, the two companies aimed to create a company with a global presence and to bring the strengths that each company had to the global automobiles market. At first sight, the companies appeared to be equal partners in the merger. The companies at the time of the merger were almost equal in size. In addition, the companies appeared ideal for a merger because each had specific strengths which could be complemented by the other. Chrysler, founded and having its main operations in the US, was a company that emphasized innovation and flexibility while its counterpart, Daimler Benz, was a company characterized by structured, hierarchical management and German engineering excellence. These apparent equal partners were thus ideal for a mutually beneficial merger. In addition, the two companies were among the market leaders in their areas of specialization, and their Continue reading

Case Study: The Strategic Alliance of Fiat And Chrysler

Corporations, firms, and companies implement stringent measures to improve operations during periods of severe financial constraints. Many livelihoods depend on their stability and it would be unethical to fail to take action. In addition, it is necessary to protect the investments and interests of stakeholders who would be affected if the businesses collapsed. Therefore, it is crucial for organizations and companies to take necessary steps to safeguard interests of stakeholders. The 2009 strategic alliance between Chrysler and Fiat was a bold move towards saving Chrysler, a company that had operated for many years. The merger was a major setback for Chrysler to a certain degree. Chrysler lost a lot of money when it allowed Daimler to relinquish its portion of the company to Cerberus because the offer price was less than a quarter of the initial capital. However, the merger saved Chrysler because it was in a financial crisis that Continue reading

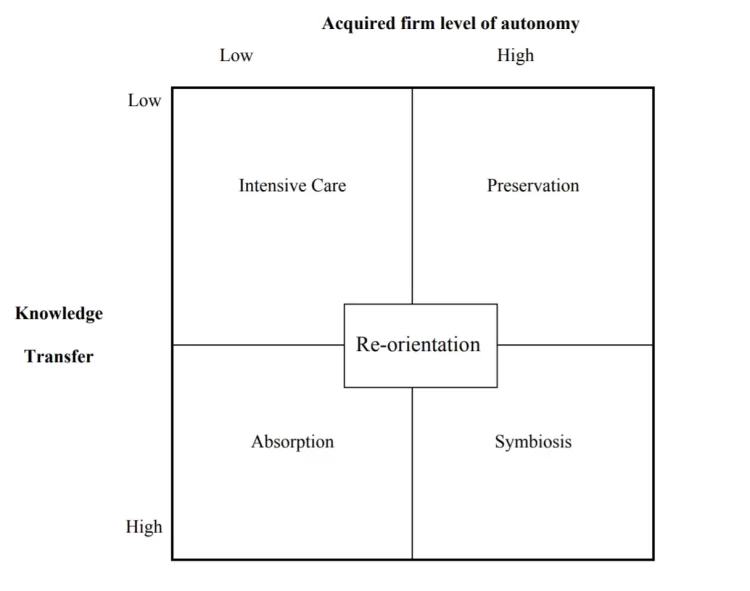

Cultural Integration in Mergers and Acquisitions

First, it is necessary to understand why the field of cross-cultural differences is vital to business interactions. In many situations, it is beneficial for companies to merge. Some businesses are failing to perform on their own, but still possess resources that may be valuable for businesses in the same sphere. Other companies aim to expand to increase their growth and support the rising demand for their services. Overall, joint ventures and alliances happen to raise the value of the merging entities, whether this value is connected to the brands presence, technologies and other resources or economies’ scaling. Cross-border acquisition and merger can be motivated by these factors as well – companies often want to enter new markets, for which international collaboration is essential. Its unique challenge, however, is that the market the foreign company is entering is completely new to it in many aspects. Merger and acquisition (M&A) are processes Continue reading