Among the most attention-grabbing dramas to come out of the Great Recession was the marriage of Fiat and Chrysler. Financed and brokered by the United States government in an unmatched market intervention, the amalgamation brought two outstanding companies together whose histories were strangely similar but whose prospects had recently diverged. Chrysler is an American symbol one of Detroit has framed titanic three in the auto industry. Chrysler is a company with a turbulent history having experienced several cycles of booms and busts. The company fell on hard times and needed a government bailout in the year 1979. Chrysler managed to pay up the government loan and continued to be successful in the auto industry for a better part of the years. This improvement in its activities was under the leadership of the legendary Lee Lacocca. In the mid 1990s, Chrysler was a strong and growing company, and this aspect led it Continue reading

Corporate Strategies

Strategy Development and Leveraging Core Competencies

Strategy allows an organisation to deliver its vision. To develop a deliberate strategy which could potentially increase the sustainability of an organisation clearly requires the identification of core competencies but often a single strategy is not the answer. Organisations require a headline strategy to fit a brief which resonates the vision but several strategies are required over many departments such as research and development, production and marketing to deliver the main strategy. The process of strategy development is complex and methodology depends on several factors including the availability of resources and the external environment. The second step in strategy development following identification of core competencies, which is the process of leveraging resources so they can be exploited for maximum benefit. An organisation’s resources can be tangible, intangible or human and that these can be matched to its capabilities to eventually provide competitive advantage. This process of exploiting the unique combination Continue reading

Transferring Core Competencies for Organization Success

Development and expansion organizations’ core competency is one of the main success factors of many organizations. However, if organizations do not apply correct measures when transferring core competencies for one business to another, the likelihood of failure is high. Transfer of core competencies is one of the most important business diversification strategies of ensuring organizations reduce costs of starting over again in new business ventures. Transferring core competencies and resource strengths from one country market to another is a good way for companies to develop broader or deeper competencies and competitive capabilities that can become a strong basis for sustainable competitive advantage. It mostly works via capitalizing on operational relatedness, primarily applying the constrained multi-product strategy. This strategy offers organizations a chance of realizing and exploiting economies of scope, a crucial pathway for gaining a competitive advantage over other businesses. In addition, it guarantees organizations opportunities for utilizing existing expertise Continue reading

General Issues of Balanced Scorecard (BSC) Implementation in Organizations

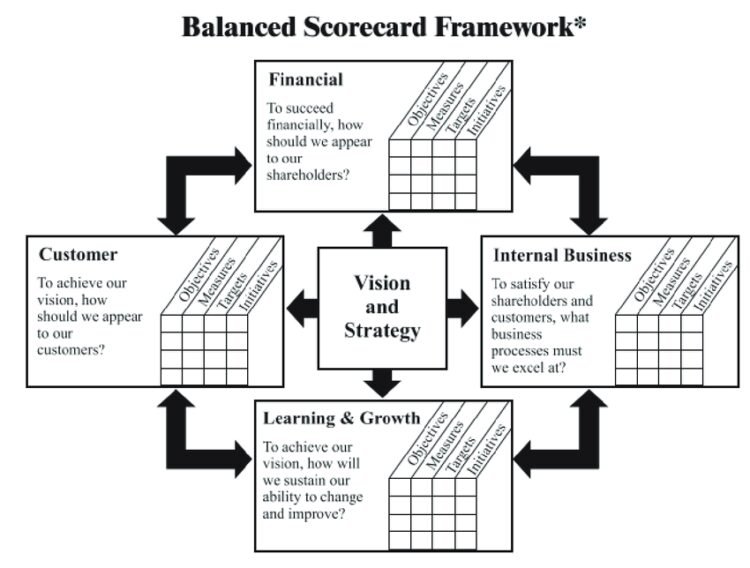

For modern organizations, it is essential to have methods for collecting data and making decisions based on the strategic objectives that lead to the achievement of competitive advantage. The balanced scorecard (BSC) represents strategic planning and management that companies use for communicating their intended accomplishments, aligning everyday procedures with the formulates strategy, monitoring progress, and prioritizing projects. In general, BSC is used for measuring and providing feedback to organizations, with data collection being crucial to the provision of quantitative results. This data is interpreted by managers and executives who make further decisions for an organization. The concept of Balanced Scorecard (BSC) was first introduced by Kaplan and Norton who received great praise for their research. The key principle behind the concept lies in finding balance across all functions of an organization since the majority of companies focus on financial measures such as growth and profitability, forgetting about such sectors as Continue reading

Business Strategy Implementation

The business strategy will be implemented through the concerted actions of all staff working within a partnership framework. The Board will set objectives and parameters, for the business strategy implementation, and will review progress in achieving objectives. Management will take ownership, give leadership and agree with staff clearly defined roles and responsibilities in achieving targets and milestones. It is also recognized that resources issues may affect the full implementation of the strategy. To assist management in carrying out its role in delivering the strategy and whatever may evolve in the future, an integrated management development programme, with a particular focus on business planning and performance management, will a particular focus on business planning and performance management, will be provided. It is anticipated that other issues will emerge as the process evolves. The project groups will comprise of management and staff, at all levels, who have expressed an interest, and who Continue reading

Business Level Strategy vs Corporate Level Strategy

Business level strategy is defined as an organizational strategy that seeks to determine how an organization should compete in each of its businesses. In contrast, corporate level strategy is an organizational strategy that seeks to determine what business a company should be or wants to be. At the heart of business level strategy is the role of competitive advantage. This is what sets a company apart from its competitors and gives it a distinct edge. Sustaining competitive advantage will be based on the interplay of the five forces in an industry. According to Porter (1990), these five forces are the threat of new entrants, the threat of substitutes, the bargaining power of buyers, the bargaining power of suppliers and rivalry among firms. By performing an industrial and internal analysis, a firm can then identify its competitive advantages so that it can pursue the right strategy. There are a few major Continue reading