International Business Machines Corporation, or the IBM, is basically a multinational computer technology and has got hold over IT consulting services. The company has established itself as one of the selected information technology companies since 19th century. With its growth in the manufacturing as well as marketing domains of computer hardware and software, it has gained the nickname of “Big Blue”. IBM had encouraged its employees to use internet since 1997 when most of the companies were not allowing their employees use of internet. In 2003, the company made a strategic decision to encourage IBMers to participate in blogs and embrace the blogosphere. Social Business @ IBM is an internal site that has interactive, educational and social programs which explain IBM’s social business transformation and educates and enables IBMers in external social media participation. Employees take personal responsibility for their social media activities and the company has set Continue reading

Corporate Strategies

Divestitures in Business – Concept, Reasons, and Benefits

In the modern world, so many organizations are using several strategies to enhance their performance and improve their competitive advantages. Some of the mostly relied on strategies are divestitures or mergers & acquisitions. The two though somehow different have some similarities. Mergers and Acquisitions refers to two companies combining together to form a single entity or one parent company absorbing another company and completely eliminating the entity of the target company to incorporate its operations in the parent company. Divestitures or rather divestment on the other hand is the opposite of investment and refers to the reduction/addition of the firm’s partial assets or complete sale of an existing business by a firm due to some ethical or business reasons. One of the reasons behind the above corporate strategies is to increase the firm’s chances of survival in a market environment characterized by many competitors and in particular perfect market industry. This is Continue reading

Foreign Market Entry Modes – Five Modes of Foreign Market Entry

Changes in the internal and external business environment have meant that more and more firms are expanding their operations across country borders. External factors such as: the removal of trade barriers, free trade agreements between countries, and an emerging middle class has made the idea of going global more attractive to organisations across the world. Internal factors such as: increasing profits, increasing market share and becoming a global brand are more drivers for organisations to globalize. Whilst there are a lot of drivers of internationalization, and hence potential advantages to internationalize. Types of Foreign Market Entry Modes An organisation has a number of different entry modes to choose from when it internationalizes its operations. All organisations will have different reasons for going global, which will have an influence on which entry mode is best suited to them. An organisation will need to determine their desired level of commitment, flexibility, control, Continue reading

Resource Based View (RBV) and Sustainable Competitive Advantage

Resource based view (RBV) focuses on the internal factors that contribute to a firm’s growth and performance. It highlights the importance of firm’s resources and capabilities. Both of them will together form a competency that can create a competitive advantage. Resources can also be divided into tangible resources and intangible resources. Capabilities of the firm in utilizing the resources have a big impact on how a firm will be able to stand out among other competitors. Competitive advantage arises when a firm has a lower cost structure, products differentiation and niche markets. RBV also concerns in value creation in order to compete with others. On the other hand, in order to survive in this competitive world, a firm needs to fully prepare itself to achieve sustainable competitive advantage (SCA), which means having a superior performance in a longer term compared to other rivals. According to Jay Barney (1991), resources need Continue reading

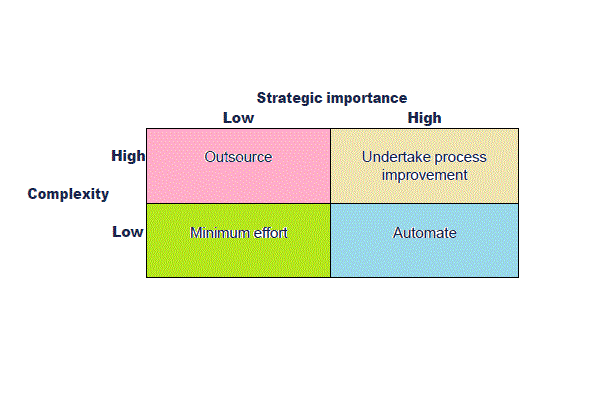

Harmon’s Process-Strategy Matrix

Process-Strategy matrix by Paul Harmon will be useful in deciding how the process should be managed, it gives two variable one Is importance and other is complexity and dynamics. There may be other variables to consider in practice such as culture, cost and savings and quality. It should be used flexibly by considering all the variable affecting the current and future prospects of the organization. Advantages and disadvantages should be considered before reaching the final decision. How To Assess The strategic Importance? Strategic importance can be assessed by asking what would happen if a process is abandoned. If it impacts the business objective (Quality, cost control and reputation etc.) materially (more than insignificant) than it can be assessed as high strategic importance like threatening to the survival of business. Strategic importance can also be assessed by identifying key stakeholders. If the process affecting the key stakeholders like customers, Tax authorities Continue reading

Importance of Stakeholder Engagement in Business

Stakeholders are all those people or businesses that are essential for a company, because they contribute to keep it afloat or in operation. They can be affected if their expectations or needs are not met. There are three interested parties: suppliers, customers and investors. Each of them is an indispensable part. Without its essential contribution, the business could not be sustained or built. Suppliers provide the input, customers are those who consume our products and refer us to new prospects and investors or owners, contribute their capital for the sustainable development of the business. Stakeholders can benefit or be harmed by any action or decision taken. That is why every business or company must identify them and know their needs and expectations to fulfill them. Since above all, they are the ones that contribute in a special way to our business. Stakeholders have increasingly become an essential component of business Continue reading