In the past, the vast majority of departments used direct labor hours as the only cost driver for applying costs to products. But direct labor hours is not a very good measure of the cause of costs in modern, highly automated departments. Labor-related costs in an automated system may be only 5 percent to 10 percent of the total manufacturing costs and often are not related to the causes of most manufacturing overhead costs. Therefore, many companies are beginning to use machine-hours as their cost-allocation base. However, some managers in modern manufacturing firms and automated service companies believe it is inappropriate to allocate all costs based on measures of volume. Using direct labor hours or cost-or even machine hours-as the only cost driver seldom meets the cause/effect criterion desired in cost allocation. If many costs are caused by non volume-based cost drivers, Activity Based Costing (ABC) should be considered Activity Continue reading

Economics Basics

Types of Demand

Supply and demand is perhaps one of the most fundamental concepts of economics and it is the backbone of a market economy. generally resulting in market equilibrium where products demanded at a price are equaled by products supplied at that price. Demand depends on the price of the commodity and refers to how much (quantity) of a product or service is desired by buyers. The quantity demanded is the amount of a product people are willing to buy at a certain price; the relationship between price and quantity demanded is known as the demand relationship. Read: Concept of Demand in Managerial Economics The different types of demand are; i) Direct and Derived Demands Direct demand refers to demand for goods meant for final consumption; it is the demand for consumers’ goods like food items, readymade garments and houses. By contrast, derived demand refers to demand for goods which are needed Continue reading

Difference Between Economies of Scale and Economies of Scope

Economies of Scale The term economies of scale refers to a situation where the cost of producing one unit of a good or service decreases as the volume of production increases. Economies of scale arise when the cost per unit falls as output increases. Economies of scale are the main advantage of increasing the scale of production. Alfred Marshall made a differentiating concepts of internal and external economies of scale. That is that when costs of input factors of production go down, it is a positive externality for all the firms in the market place, outside the control of any of the firms. Internal Economies of Scale Internal economies of scale relate to the lower unit costs a single firm can obtain by growing in size itself. This means that the internal economies are exclusively available to the expanding firm. Internal economies of scale may be classified under the following Continue reading

The Role of Government in a Market Economy

In a market economy, commerce and customers make a decision of their own decision what they will consume and manufacture, and in which conclusions on the allotment of those sources are without government interference. Hypothetically this denotes that the manufacturer is required to decide what to produce, how much to produce, what prices to set up for consumers for those productions, what to pay workers, and so on. These conclusions in a market financial system are impacted by the forces of competition, supply, and demand. This is frequently distinguished with a premeditated economy, where central government concludes what will be manufactured and in what amounts. A market economy is also compared with the mixed economy where there are market processes through the system of markets that is not completely free but under some state control that is not widespread enough to comprise a deliberate financial system. In reality, there is Continue reading

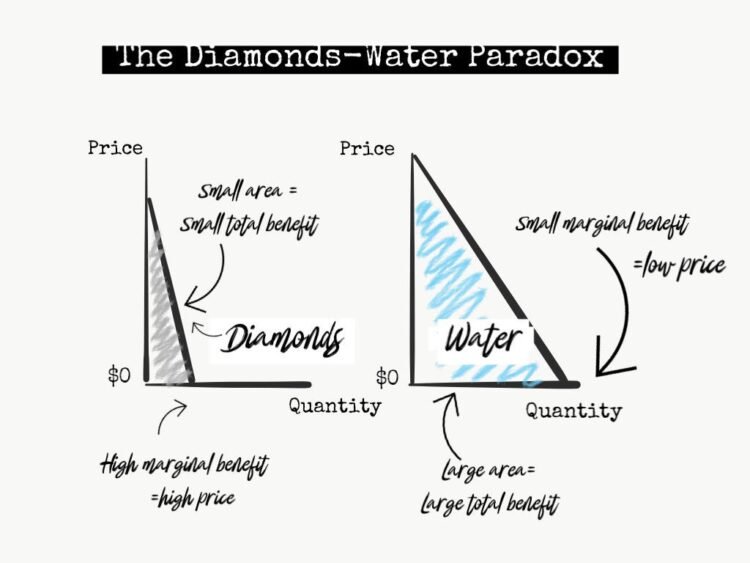

The Diamond-Water Paradox in Economics

The concept of the value of goods was one of the most actively discussed topics by economists in the 18-19th century. In “A Study of the Nature and Causes of the Wealth of Nations,” published in 1776, Adam Smith voiced the question that would later become known as the diamond-water paradox. It sounded like this: “There is nothing more useful than water: but you can hardly buy anything with it… Diamond, on the contrary, has almost no use-value; but a very large number of other goods can often be obtained in exchange for it”. The classical economists Adam Smith and Karl Marx considered a product’s value concerning how it satisfies a human need. The price was associated with the effort and labor expended to meet a specific demand. Besides, classical economists used the concepts of use-value and exchange-value, which determine the nature and exchange value of products. Later, in the Continue reading

Keynesian View of Inflation

John Maynard Keynes, one of the most influential economists of the 20th century, relates inflation to a price level that comes into existence after the stage of full employment. While, the quantity approach emphasizes the volume of money to be responsible for rise in the price level. Keynes distinguishes between two types of rise in prices (1) rise in prices accompanied by increase in production, and (2) rise in prices not accompanied by increase in production. If an economy is working at a low level, with a large number of unemployed men and un-utilized resources then expansion of money or some other factors leading to an increase in demand will result not only in a rise in the price level but also rise in the volume of goods and services in an economy. This will continue until all unemployed men find employment and capital and other resources are more Continue reading