Standards of reasonable profits are determined when a firm chooses to make only reasonable profits rather than to maximize its profit. The questions that arise in this regard are as follows: What form of profit standards should be used? How should reasonable profits be determined? These questions can be understood after going through the following explanatory points. Forms of Profit Standards Profit standards is determined in terms of the following: Aggregate money terms Percentage of sales, and Percentage return on investment. All these standards are determined for each product separately. Among all the forms of profit standards, the total net profit of the firm is more common than other standards. But when the purpose is to discourage the competitors, then the target rate of return on investment is the appropriate profit standard, provided the cost curves of competitors’ are similar. The profit standard in terms of ratio to sales is Continue reading

Economics Concepts

Unemployment – Meaning, Causes and Effects

The economists describe unemployment as a condition of jobless within an economy. Unemployment is lack of utilization of resources and it eats up the production of the economy. It can be concluded that unemployment is inversely related to productivity of the economy. Unemployment generally defined as the number of persons (It is the percentage of labor force depends on the population of the country) who are willing to work for the current wage rates in society but not employed currently. Unemployment reduces the long run growth potential of the economy. When the situation arises where there are more other resources for the production and no man power leads to wastage of economic resources and lost output of goods and services and this has a great impact on government expenditure directly. High unemployment causes less consumption of goods and services and less tax payments results in higher government borrowing requirements. The Continue reading

4 Important Types of Decentralization

The term “decentralization” embraces a variety of concepts which must be carefully analyzed in any particular country before determining if projects or programs should support reorganization of financial, administrative, or service delivery systems. Decentralization—the transfer of authority and responsibility for public functions from the central government to subordinate or quasi-independent government organizations and/or the private sector—is a complex multifaceted concept. Different types of decentralization should be distinguished because they have different characteristics, policy implications, and conditions for success. Types of decentralization include political, administrative, fiscal, and market decentralization. Drawing distinctions between these various concepts is useful for highlighting the many dimensions to successful decentralization and the need for coordination among them. Nevertheless, there is clearly overlap in defining any of these terms and the precise definitions are not as important as the need for a comprehensive approach. Political, administrative, fiscal and market decentralization can also appear in different forms and Continue reading

Economic Order Quantity (EOQ) – Definition and Formula

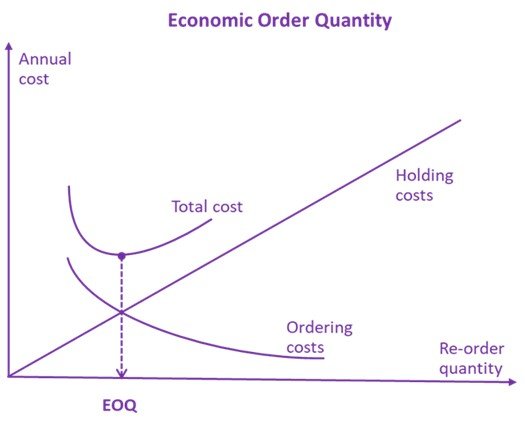

In today’s marketplace, optimization of resources, their adequate use, and cost reduction are the key attributes of a successfully developing company capable of competing effectively. For the qualitative analysis of available resources and the possibility of their optimal use in business practice, there is a large number of methods and models used depending on specific tasks. One of them is Economic Order Quantity (EOQ), which is a model used to determine the optimal quantity of goods or materials to be ordered at a given time in order to minimize the total cost of inventory. The point of minimizing inventory is to save costs since unsold goods take up space, to reduce risks since inventories can become obsolete or physically obsolete, which is especially true in the food industry, and to increase efficiency since excessive inventory can make it difficult to account for them. Thus, EOQ seeks to eliminate situations in Continue reading

Deficit Spending – Meaning, Advantages, and Disadvantages

Deficit spending occurs when a shortage of financial resources in the federal budget arises. In the modern economic environment, the economies of many countries are associated with chronic budget deficits, i.e. exceeding budget spending over national incomes. Many economists correlate budget deficits with adverse impacts on economic development – the stimulation of inflation processes, the creation of barriers to economic growth, and negative social outcomes. However, a budget deficit is not necessarily an extremely negative phenomenon, and it is argued that budget deficits can provoke the revival of national economic activity. Money creation is considered a traditional method of budget balancing. The emissive method of covering budget deficits implies the increase in monetary volumes, i.e., the government issues extra money, which is used to cover excess expenditures. The major advantage of this method is the growth of money supply that is interrelated with the increase in the aggregate demand and Continue reading

Alternative Objectives of Business Firms

The traditional theory does not distinguish between owners and managers’ interests. The recent theories of firm, which are also called managerial and behavioral theories of firm, assume owners and managers to be separate entities in large corporations with different goals and motivation. In this section, some important alternative objectives of business firms, especially of large business corporations are also discussed. 1. Baumol’s Hypothesis of Sales Revenue Maximization According to Baumol, “maximization of sales revenue is an alternative to profit maximization objective“. The reason behind this objective is to clearly distinct ownership and management in large business firms. This distinction helps the managers to set their goals other than profit maximization goal. Under this situation, managers maximize their own utility function. According to Baumol, the most reasonable factor in managers utility functions is maximization of the sales revenue. The factors, which help in explaining these goals by the managers, are following: Salary and other earnings of managers are more closely related to seals revenue than to Continue reading