The term circular economy (CE) has both a linguistic and descriptive meaning. Linguistically it is an antonym of a linear economy. A linear economy is one defined as converting natural resources into waste, via production. Such production of waste leads to the deterioration of the environment in two ways: by the removal of natural capital from the environment (through mining/unsustainable harvesting) and by the reduction of the value of natural capital caused by pollution from waste. And the word circular has a second, inferred, descriptive meaning, which relates to the concept of the cycle. There are two cycles of particular importance here: the biogeochemical cycles and the idea of recycling of products. By circular, an economy is envisaged as having no net effect on the environment; rather it restores any damage done in resource acquisition while ensuring little waste is generated throughout the production process and in the life history Continue reading

Economics Concepts

Effects of Inflation on Different Groups of Society

It is true that in times of general rise in the price level, if all groups of prices, such as agricultural prices, industrial prices, prices of minerals, wages, rent and profit rise in the same direction and by the same extent, there will be no net effect on any section of people in the community. For example, if the prices of goods and services, which a worker buys rises by 50 per cent and if the wage of the worker also rises by 50 per cent then there is no change in the real income of the worker, ie., his standard of living will remain constant. However, in practice, all prices do not move in same direction and by same percentage. Hence, some classes of people in the community are affected by inflation more favorably than others. This is explained as follows: Producing Classes: All producers, traders and speculators gain Continue reading

Economic Systems – Planned Economy, Free Market Economy and Mixed Economy

System of Planned Economy Under the conditions of the planned economy, all decisions concerning what to manufacture, how to manufacture and to whom to manufacture are approved by the sole center or group. This economy is based on collective ownership. Fixed production assets are owned by the government, and resources, production and the quantities of future products are distributed according to a plan. The type of the system of the command economy was prevailing in the USSR, Cuba, and North Korea. The plans of the system of the centralized economy are drawn up and implemented by the authorities and governmental political leaders after consulting with highly ranked professionals: engineers, economists, industrialists, and other experts. These planners decide which products to manufacture and which services to render. Their vote is decisive in approving decisions whether new undertakings are to be constructed, how many employees are to be employed at undertakings, whether Continue reading

Laws of Returns in Economics

The relationship between the inputs and the output in the process of production is clearly explained by the Laws of Returns or the Law of Variable Proportions. This law examines the production function with only one factor variable, keeping the quantities of other factors constant. The laws of returns comprise of three phases: The Law of Increasing Returns. The Law of Constant Returns. The Law of Diminishing Returns. The Laws of Returns in Economics may be stated as follows: “If in any process of production, the factors of production are so combined that if the varying quantity of one factor is combined with the fixed quantity of other factor (or factors), then there will be three tendencies about the additional output or marginal returns: Firstly, in the beginning, as more and more units of a variable factor are added to the units of a fixed factor, the additional Continue reading

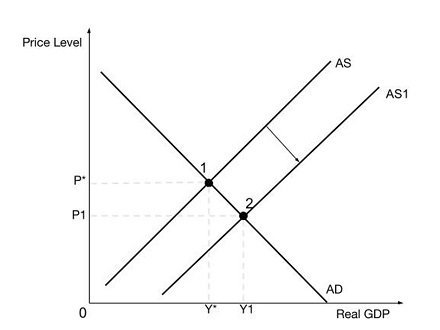

Role of Supply Side Policies in Balanced Economic Growth

The government has a responsibility for delivering public goods optimally for the collective development of all individuals. In the quest to achieve this noble course, supply side policies, which form part of macroeconomic strategies, are developed to ensure that markets and industries function in an efficient way to increase the rate of economic growth as reflected in the real national yield. Many governments support the assertion that they can achieve a sustained economic growth by improving supply side operations without causing an increase in inflation. However, reforms on the supply side policies do not facilitate the achievement of adequate growth. Definition and Explanation of Balanced Economic Growth Although the growth rate does not reflect people’s living standards entirely, economic growth has been one of the critical areas of consideration for every nation that is in the process of developing its economic policies. Indeed, economic growth is the most common approach Continue reading

Concept of Demand in Managerial Economics

In Economics, use of the word ‘demand’ is made to show the relationship between the prices of a commodity and the amounts of the commodity which consumers want to purchase at those price. Definition of Demand: Hibdon defines, “Demand means the various quantities of goods that would be purchased per time period at different prices in a given market.” Bober defines, “By demand we mean the various quantities of given commodity or service which consumers would buy in one market in a given period of time at various prices, or at various incomes, or at various prices of related goods.” Demand for product implies: a) desires to acquire it, b) willingness to pay for it, and c) Ability to pay for it. All three must be checked to identify and establish demand. For example : A poor man’s desires to stay in a five-star hotel room and his willingness to Continue reading