Nowadays shareholder value approach reflects to a modern management philosophy, which implies that an organization measures its success by enriching its shareholders. Shareholders or stockholders are individuals or institutions that owns in a legally form shares of a corporation. They are considered to be a subset of stakeholders, which are all individuals or communities, who have a direct or indirect interest in the business entity (e.g. suppliers, customers, government, competitors etc.). The philosophy of the shareholder value approach attempts to increase the organization’s value by enhancing firm’s earnings, by increasing the market value of corporation’s shares and by increasing also the frequency or amount of dividend paid. The idea is that shareholder’s money should be used to earn a higher return than it could by investing in other assets with same amount of money and risk. Furthermore according to many business analysts shareholder value approach provides managers with clear mission Continue reading

Financial Management Concepts

Working Capital Management – Definition, Significance, Objectives, and Importance

Working Capital is the part of the firm’s capital which is required for financing short term or current assets such as stock, receivables, marketable securities and cash. Money invested in these current assets keep revolving with relative rapidity and is being constantly converted into cash. These cash flows rotate again in exchange of other such assets. Working Capital is also called as “short term capital”. “Liquid Capital”, “Circulating or revolving capital”, The Working Capital management refers to management of the working capital or to be more precise the management of current assets and current liabilities. Working capital management is a very important to ensure that the company has enough funds to carry on with its day-to-day operations smoothly. A business should not have a very long Cash Conversion Cycle. A cash Conversion Cycle measures the time period for which a firm will be deprived of funds if it increases its Continue reading

Problems in Determination of Cost of Capital

It has already been stated that the cost of capital is one of the most crucial factors in most financial management decisions. However, the determination of the cost of capital of a firm is not an easy task. The finance manager is confronted with a large number of problems, both conceptual and practical, while determining the cost of capital of a firm. These problems in determination of cost of capital can briefly be summarized as follows: 1. Controversy regarding the dependence of cost of capital upon the method and level of financing There is a, major controversy whether or not the cost of capital dependent upon the method and level of financing by the company. According to the traditional theorists, the cost of capital of a firm depends upon the method and level of financing. In other words, according to them, a firm can change its overall cost of capital Continue reading

Approaches to Accounting Theories

Accounting theory is a set of basic assumptions, definitions, principles, and concepts surrounding the accounting rule. It includes the reporting of accounting and financial information to relevant or interested parties. There are several approaches that are used in the development of accounting theory. The two main ones are normative theory approach and the positive theory approach. Normative theory approach is a theory that is not based on observation. It is based on how things in the accounting process should be done. This approach comprises of different approaches to have a single but effective accounting approach. This kind of approach uses a formula to come up with an income based on value, not costs. On the other hand, positive or descriptive theoretical approach to accounting theory is a set of theories that is concerned with what accountants actually do. These theories rely on a process of inductive thinking, which involves making Continue reading

Credit Management – Managing Trade Credit and Accounts Receivable in Business

“The purpose of any commercial enterprise is the earning of profit, credit in itself is utilized to increase sale, but sales must return a profit.” – Joseph L. Wood The primary objective of management of receivables should not be limited to expansion of sales but should involve maximization of overall returns on investment. So, receivables management should not be confined to mere collection or receivables within the shortest possible period but is required to focus due attention to the benefit-cost trade-off relating to numerous receivables management. Principles of Credit Management In order to add profitability, soundness and effectiveness to receivables management, an enterprise must make it a point to follow certain well-established and duly recognized principles of credit management. The first of these principles relate to the allocation of authority pertaining to credit and collections of some specific management. The second principle puts stress on the selection of proper credit Continue reading

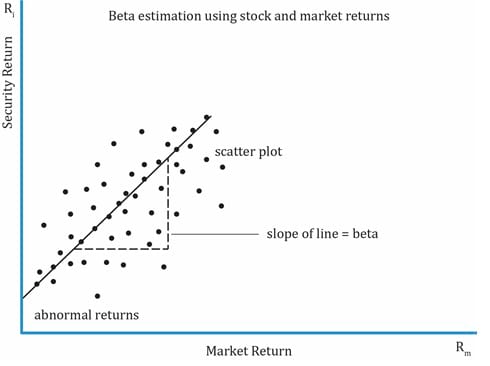

Stock Beta – Meaning, Calculation, Applications and Types

In finance, the Beta (β) of a stock or portfolio is a number describing the correlated volatility of an asset in relation to the volatility of the benchmark that said asset is being compared to. This benchmark is generally the overall financial market and is often estimated via the use of representative indices, such as the S&P 500, Nifty, Sensex, etc. Beta is also referred to as financial elasticity or correlated relative volatility, and can be referred to as a measure of the sensitivity of the asset’s returns to market returns, its non-diversifiable risk, its systematic risk, or market risk. On an individual asset level, measuring beta can give clues to volatility and liquidity in the marketplace. In fund management, measuring beta is thought to separate a manager’s skill from his or her willingness to take risk. The beta coefficient was born out of linear regression analysis. It is linked to a regression analysis of the returns of a portfolio (such as a stock index) (x-axis) in a specific period versus the returns Continue reading