Definition of Capital Gearing The most important factor which must be taken into account by the promoters while drafting the financial plan of a company is capital gearing. Gearing means the ration of different types of securities to total capitalization. The term, when applied to the capital of a company, means the ratio of equity share capital to the total capital and is known as capital gear ratio or capital gearing. J. Batty defines the term ‘capital gearing’ as “The relation of ordinary shares (equity shares) to preference share capital and loan capital is described as the capital gearing.” Thus the term capital gearing is used to indicate the relative proportion of fixed cost bearing securities such as preference shares and debentures to the ordinary share capital in the capital structure. Interest of equity share holders is represented by the amount of share capital plus retained earnings and undistributed profits. Continue reading

Financial Management Tools

Approaches to Accounting Theories

Accounting theory is a set of basic assumptions, definitions, principles, and concepts surrounding the accounting rule. It includes the reporting of accounting and financial information to relevant or interested parties. There are several approaches that are used in the development of accounting theory. The two main ones are normative theory approach and the positive theory approach. Normative theory approach is a theory that is not based on observation. It is based on how things in the accounting process should be done. This approach comprises of different approaches to have a single but effective accounting approach. This kind of approach uses a formula to come up with an income based on value, not costs. On the other hand, positive or descriptive theoretical approach to accounting theory is a set of theories that is concerned with what accountants actually do. These theories rely on a process of inductive thinking, which involves making Continue reading

Stock Beta – Meaning, Calculation, Applications and Types

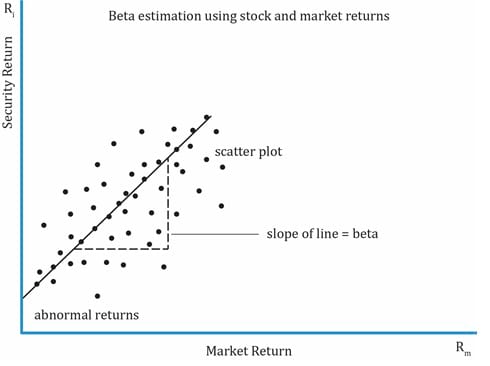

In finance, the Beta (β) of a stock or portfolio is a number describing the correlated volatility of an asset in relation to the volatility of the benchmark that said asset is being compared to. This benchmark is generally the overall financial market and is often estimated via the use of representative indices, such as the S&P 500, Nifty, Sensex, etc. Beta is also referred to as financial elasticity or correlated relative volatility, and can be referred to as a measure of the sensitivity of the asset’s returns to market returns, its non-diversifiable risk, its systematic risk, or market risk. On an individual asset level, measuring beta can give clues to volatility and liquidity in the marketplace. In fund management, measuring beta is thought to separate a manager’s skill from his or her willingness to take risk. The beta coefficient was born out of linear regression analysis. It is linked to a regression analysis of the returns of a portfolio (such as a stock index) (x-axis) in a specific period versus the returns Continue reading

Beyond Budgeting Approach

A traditional budget is usually prepared by reviewing past year’s budget and actual expenses, with addition or deduction towards extra business activities or reduced business activities planned and also by effecting changes towards changing factors, such as growth, inflation etc. It is basically to tie managers to predetermined actions in order to achieve the planned budget. It is usually based on organizational hierarchy and centralized leadership. In a business that operates in a very dynamic, rapidly changing, and innovative environment, traditional budgeting is inappropriate to exercise. Budget is a barrier for the business because the vibrant market demands flexibility, fast response, innovation, process improvement, customer focus, and shareholder value. And it is the limitation of the traditional budgeting not to be able to fulfill these demands. The dynamic driven business should keep up with the change and adaptive to recent development to achieve success. Hence Beyond Budgeting approach introduced. The Continue reading

Cost Accounting – Definition, Objectives, Scope and Limitations

DEFINITION OF COST ACCOUNTING An accounting system is to make available necessary and accurate information for all those who are interested in the welfare of the organization. The requirements of majority of them are satisfied by means of financial accounting. However, the management requires far more detailed information than what the conventional financial accounting can offer. The focus of the management lies not in the past but on the future. For a businessman who manufactures goods or renders services, cost accounting is a useful tool. It was developed on account of limitations of financial accounting and is the extension of financial accounting. The advent of factory system gave an impetus to the development of cost accounting. Cost Accounting is a method of accounting for cost. The process of recording and accounting for all the elements of cost is called cost accounting. The Institute of Cost and Works Accountants, London defines Continue reading

Altman Z-Score Formula – Corporate Bankruptcy Prediction Model

The financial failure of a company can have a devastating effect on the all seven users of financial statements e.g. present and potential investors, customers, creditors, employees, lenders, general public etc. As a result, users of financial statements as indicated previously are interested in predicting not only whether a company will fail, but also when it will fail e.g. to avoid high profile corporate failures at Enron, Arthur Anderson, and WorldCom etc. Business failure is defined as the unfortunate circumstance of a firm’s inability to stay in the business. Business failure occurs when the total liabilities exceeds the total assets of a company, as total assets is consider a measure of productivity of a company assets. The main reasons for business failure are high interest rates, recession squeezed profits, heavy debt burdens, government regulations and the nature of operations can contribute to a firm’s financial distress. The traditional analysis of Continue reading