Public good refer to a commodity whose utilization is determined by the society and not an individual and financed by means of taxation. In contrast, an International public good can be defined as a utility that provides specifically well-defined benefits to everyone across the globe. An international public good does not imply that benefits are available to every person in every country but means that they are available to the global public per se. The effectiveness of public goods depends on two core factors: individuals’ preferences or taste, and capability for consumption. For example, uneducated individuals cannot benefit from global knowledge because of their inability to read and comprehend knowledge material. The Economic Concept of Public Goods A public good can be defined on economic basis as a utility that everybody enjoys in union with others in the sense that the consumption of that good by an individual does not Continue reading

International Economics

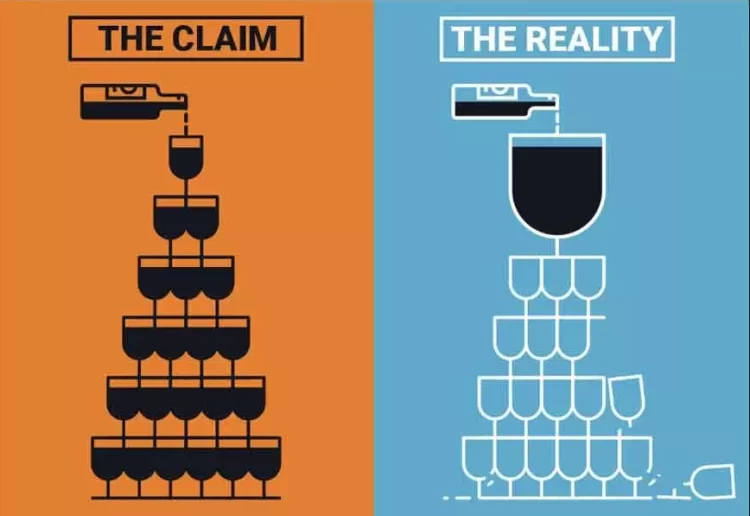

Trickle-Down Economics or Reaganomics

In economics and politics, the term trickle-down economics or Reaganomics is the pejorative term for the theory that taxing the wealthiest individuals in society less will in allow those individuals to invest more of their money into the economics development and create new jobs for the middle and lower class. Proponents for the theory use the term supply-side economy, considering that the idea of the middle to lower classes tangentially receiving benefits through economics policy which directly benefit the rich is somewhat insulting. The basic idea is that the recipients of the tax cuts will then be able to invest more money into infrastructure, opening more stores and companies, which will then provide more jobs as well as drive down the prices of goods. However, in terms of economic theory, there have been no major economists who have ever supported this theory or have attempted to defend the “trickle-down” aspect Continue reading

Market Economy – Overview, Features, Characteristics, Advantages and Disadvantages

A market economy can be defined as an economy in which the allocation of resources is determined only by their supply and the demand for them. Market economy can also be defined as an economic system in which economic decisions and the pricing of goods and services are guided solely by the aggregate interactions of a country’s citizens and businesses and there is little government intervention or central planning. To conclude, the market economic system is basically a system whereby private individuals take up the responsibility of allocating resources to the public and relies chiefly on market forces to determine prices. Countries practicing the market economic system tend to assume that the forces of demand and supply are the main determinants of what is right for a nation’s well-being. They {the countries} rarely experience government interventions such as price fixing, license quotas and industry subsidizations. In reality, the market economy Continue reading

Monopsony and Competition Law in Indian Context

Can a buyer be the biggest bully? The classical theory of monopsony answers this question. It envisions a market scenario with only one buyer, who can use his leverage to reduce the quantity of product purchased, thereby driving down the price that he has to pay. Seldom does a monopsonistic situation arise in the market, so much so that little has been thought till date about the potential adverse impact of such a scenario on market competition. Another reason for the antitrust analyst’s apparent neglect of the power on the buyer’s side of the market may be that such power tends to reduce the selling price of a commodity, thereby causing a prima facie increase in consumer welfare, which has always been one of the traditional goals of competition law. Classical Monopsony -What does It Entail? Pure monopsony can be looked upon as the demand-side analogue of the monopolist who Continue reading

Alfred Chandler’s Model of Integrated Managerial Enterprise

Managerial enterprises received the priority and governmental focus in the modern economic strategy that led to the fast and impressive growth of the economies of developed countries. Numerous countries have chosen the model designed by Alfred Chandler as the primary tool for changing the perspectives and visions to transform and grow to become powerful national economic enterprises. The model is based on the economic logic. The decisions made by managers based on this approach had a momentous impact on the path of economic advancement of Germany making this country one of the most influential players in the global arena, increasing production level in the United States, and helped Japan reach its leading position in the world. Adherence to the economic logic became the engine for the economic improvement. However, weak implementation of the Chandler’s model consequently led the United States to the decline in the competitiveness in machinery and electronics Continue reading

The Bretton Woods System – Background, Design and Reasons for Collapse

Since the beginning of the 19th century, globalization, international trade and free trade between countries became the new economic order and several attempts have been made since then to develop policies and schemes to ensure the stability of the international monetary system. It is safe to say that in truth, the world economy has never been in a state of utopia, but nevertheless, we have never stopped trying to attain such. The Bretton Woods era of 1944 to 1977, one of the few fairly successful schemes the world powers created in trying to achieve economic utopia, though existed for a short period, has been accredited as being one of the most successful international monetary systems, so impressive was the economic stability and growth of the era that there have been ongoing talks for a comeback of the system. Background of the Bretton Woods System At the end of the World Continue reading