Regional Economic Integration means agreements between groups of countries in a geographic region to reduce and ultimately remove tariff and non-tariff barriers for the free flow of goods, services and factors of production between each other. GATT and WTO are the biggest association of more than 140 member countries, which strive to reduce the barriers. However, more than regional, WTO has a global perspective. By entering into regional agreements, groups of countries aim to reduce trade barriers more rapidly than can be achieved under WTO. While there have been decreases in the global barriers to trade and investment, the greatest progress had been made on a regional basis. There are many examples in the current popular push on the European Union (EU) and the effects the EU have on a particular business or industry that illustrates this point. Perhaps the best example of the benefits of economic integration and political Continue reading

International Economics

Global Company Competitiveness Analysis

A domestic company may extend its products to foreign markets by exporting, licensing and franchising. Initially, the exporting is indirect. It may develop a more serious attitude towards foreign business and move to the next stage of development. International company is normally the second stage in the development of a company towards transnational corporation. The orientation of the company is basically ethnocentric and the marketing strategy is extension. The marketing mix developed for the home market is extended into the foreign markets when a company decides to respond to market differences, it involves into the stage there multinational that pursues a multidomestic strategy. Multinational company’s each foreign subsidiary is managed as if it were an independent city stage. The subsidiaries are part of an area structure in which each country is part of a regional organization that reports to world headquarters. The transnational corporation is much more than a company Continue reading

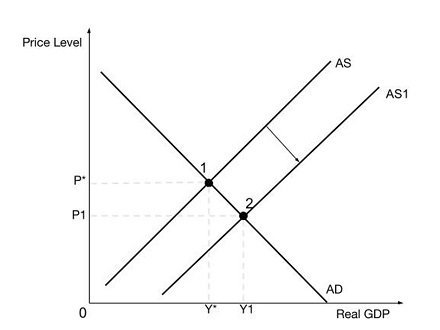

Role of Supply Side Policies in Balanced Economic Growth

The government has a responsibility for delivering public goods optimally for the collective development of all individuals. In the quest to achieve this noble course, supply side policies, which form part of macroeconomic strategies, are developed to ensure that markets and industries function in an efficient way to increase the rate of economic growth as reflected in the real national yield. Many governments support the assertion that they can achieve a sustained economic growth by improving supply side operations without causing an increase in inflation. However, reforms on the supply side policies do not facilitate the achievement of adequate growth. Definition and Explanation of Balanced Economic Growth Although the growth rate does not reflect people’s living standards entirely, economic growth has been one of the critical areas of consideration for every nation that is in the process of developing its economic policies. Indeed, economic growth is the most common approach Continue reading

The Advantages and Disadvantages of Globalization

Globalization has become a hot-debated issue in the last ten to twenty years. Globalization is affecting the world from different perspectives, such as political perspective, economic perspective, and cultural perspective. Currently, whether globalization can bring more positive effects or negative effects to the modern world is still open to debate. Different scholars around the world hold distinctive views regarding the definition of globalization, but in this article, the following two definitions are used. Globalization refers to the creation and intensification of global linkages. In addition, globalization also refers to the compression of the world and the intensification of consciousness of the world as a whole. One of the main ideas of globalization is to break the barriers between countries. Everyone can receive information about different events happening in the world instantly. In the era of globalization, breaking barriers between countries is inevitable. Trading, foreign investments, population movements, these activities across Continue reading

Dornbusch Exchange Rate Overshooting Model

The Dornbusch overshooting model, developed by Rudiger Dornbusch in 1976, is a theoretical framework used to explain the dynamics of exchange rates. It suggests that when there is a change in monetary policy or other economic factors, exchange rates overshoot their long-run capital flows before settling back to their equilibrium levels. The model helps explain the short-term volatility of exchange rates, which can have significant implications for international trade, investment, and capital flows. Assumptions of the Model: The Dornbusch overshooting model is based on several key assumptions. First, it assumes that prices and wages are sticky in the short run, meaning that they do not adjust immediately to changes in economic conditions. This is because many contracts, such as labor contracts and long-term supply contracts, are negotiated in advance and do not reflect current market conditions. As a result, changes in the money supply or other economic factors can lead Continue reading

Foreign Direct Investment Incentives

Incentives are any measurable economic advantage afforded to specific enterprises or categories of enterprises by (or at the direction of) a government, in order to encourage them to behave in a certain manner. They include measures either to increase the rate of return of a particular FDI undertaking, or to reduce (or redistribute) its costs or risks. They do not include broader nondiscriminatory policies, relating to the availability of physical and business infrastructures, the general legal regime for FDI, the general regulatory and fiscal regime for business operations, free repatriation of profits or the granting of national treatment. While these policies certainly bear on the location decisions of TNCs, they are not Foreign direct investment incentives. The main types of Foreign direct investment incentives used are fiscal incentives (e.g. reduction of the standard corporate income-tax rate, investment and reinvestment allowances, tax holidays, accelerated depreciation, exemptions from import duties), financial incentives Continue reading