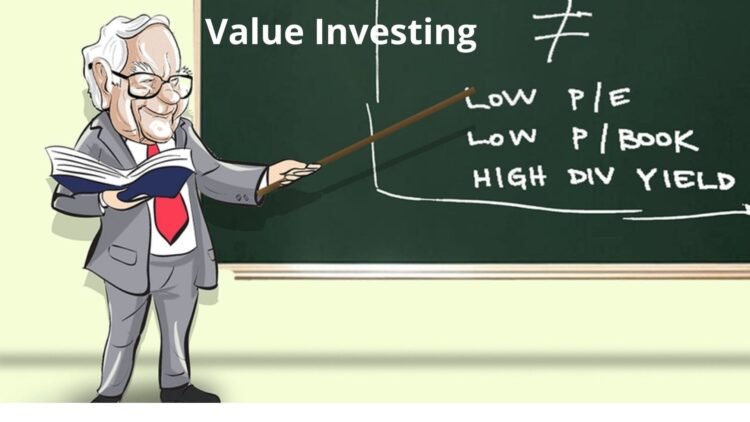

Value investing as a philosophy of investing started its evolution at the beginning of the twentieth century when Benjamin Graham started teaching this investing strategy in Columbia Business School in 1927. Later, in 1934, one of his students, David Dodd, published Graham’s lectures as Security Analysis that is considered to be a bible for value investors. Today, any investor who is keeping to this strategy may be referred to as Graham-and-Dodd investor. This philosophy has one attractive advantage – one does not need to be a finance genius to become a successful value investor; all he needs is money to invest, patience and time and desire to read some books and do some accounting. It gained popularity because of success of one of its most famous followers, Warren Buffett, who once said about it: ” The investment shown by the discounted-flows-of-cash calculation to be the cheapest is the one that the investor Continue reading

Investment Options

Shareholder Activism – Concept, Definition, Advantages, and Disadvantages

According to economic experts, shareholder activism refers to a process through which an individual with equity in a publicly traded corporation attempts to use his or her shareholder rights to pressure the management team into making changes. Shareholders are partial owners of a corporation. Thus they have rights they can exercise to influence a change of behavior. However, achieving this feat is highly dependent on one’s share classification. Major shareholders have a greater influence over the running of a corporation compared to minority shareholders who only have limited options such as proxy battles, publicity campaigns, litigation, as well as writing formal proposals that are voted for during annual meetings. An activist shareholder focuses on pressuring the management to make financial and non-financial changes that range from the corporate policy, financing structure, disinvestment, adoption of environmentally conscious policies to cost-cutting measures, among others. Several publicly listed companies in the United States Continue reading

Socially Responsible Mutual Funds – Definition, Advantages, and Disadvantages

A mutual fund is an investment vehicle that is made up of a pool of funds collected from many investors for the purpose of investing in securities such as stocks, bonds, money market instruments and similar assets. The funds are managed by what is referred to as fund managers who invest the fund’s capital to generate income and capital gains for the investors. A socially responsible mutual fund is defined as one that holds securities in firms that observe and adhere to moral, religious, social and environmental beliefs or ethics. The funds also hold securities in firms that demonstrate high standards of corporate citizenship or Corporate Social Responsibility. The concept of corporate citizenship is generally used to refer to the relationship between businesses and their environment. All businesses operate in social, political, economic, and natural environments. The concept, therefore, takes into account how businesses interact with these environments, either positively or Continue reading

Risks Associated with Derivatives

Although derivatives are legitimate and valuable tools for hedging risks, like all financial instruments they create risks that must be managed. Warren Buffett, one of the world’s most wise investors, states that “derivatives are financial weapons of mass destruction, carrying dangers that, while now latent, are potentially lethal.” On one hand derivatives neutralize risks while on the other hand they create risks. In fact there are certain risks inherent in derivatives. Derivatives can be dangerous if not managed properly. Numerous financial disasters such as Enron can be related to the mismanagement of derivatives. In the 1990s, Procter & Gamble lost $157 million in a currency speculation involving dollars and German Marks, Gibson Greetings lost $20 million and Long-Term Capital Management, a hedge fund, lost $4 billion with currency and interest-rate derivatives. It is key to consider that it has not been the use of derivatives as a tool which has Continue reading

An Overview of Hedge Fund Strategies or Hedging Techniques

Hedge funds are pools of investment that invest in almost any opportunity in any market where they foresee impressive gains at reduced risk. Hedging refers to implementing strategies that manage or protect against an identified risk exposure. They take leveraged positions in publicly traded equity, debt, foreign exchange and derivatives. The primary aim of most hedge funds is to reduce volatility and risk while attempting to preserve capital and deliver positive returns under all market conditions. Derivatives provide institutions the opportunity to break financial risks into smaller components and then to buy or sell those components to manage risk. Hedge funds hold a number of assets; they use derivatives to protect against the adverse price movement of these assets. Hedge funds play more of the role of speculators than of hedgers. They use derivatives when buying and selling assets and by putting long-short positions, they seek to hedge themselves against Continue reading

Factors to Consider in Making Financial Investment Decisions

When investing, it is fundamental for an investor to make a comparison of various investment opportunities and determine which investment promises a higher return while ensuring that risks are minimized. The analysis sometimes requires a thorough examination of elements associated with various types of investments. An investor should consider features such as interest rates, maturity period, risks, required rate of return, and upfront payments. Notably, investments differ in various aspects including minimum level of capital required, periodic payments, and income, among other features. For instance, an individual intending to invest in equities would find that dividends for stocks vary according to the market situation. However, the investor would also notice that apart from dividends, an individual would earn capital gains if he or she invested in equities. On the other hand, an individual considering an investment in bonds would find that bonds have a fixed maturity period that may determine Continue reading