Definition of Technical Analysis Technical analysis is the process of utilizing past trading information and stock price trends related to a specific security, and then equating those to how other likewise investments have responded throughout history to similar patterns. Further, when a pattern is identified, the investor can predict that the future pricing of the target investment is likely to respond in a similar manner to patterns observed earlier. Technical analysis of stocks assumes that current prices should represent all known information about the markets. Prices not only reflect intrinsic facts, they also represent human emotion and the pervasive mass psychology and mood of the moment. Prices are, in the end, a function of supply and demand. However, on a moment to moment basis, human emotions,fear, greed, panic, hysteria, elation, etc. also dramatically affect prices. Markets may move based upon people’s expectations, not necessarily facts. A market “technician” attempts to Continue reading

Investment Terms

International Equity Investments – Euro Equities

International equities or the Euro equities do not represent debt, nor do they represent foreign direct investment. They are comparatively a new financial instruments representing foreign portfolio equity investment. In this case, the investor gets the dividend and not the interest as in case of debt instruments. On the other hand, it does not have the same pattern of voting right that it does have in the case of foreign direct investment. In fact, international equities are a compromise between the debt and the foreign direct investment. They are the instruments that are presently on the preference list of the investors as well as the issuers. Benefits to Issuer/ Investor The issuers issue international equities under certain conditions and with certain objectives. First, when the domestic capital market is already flooded with its shares, the issuing company does not like toad further stress to the domestic stock of shares since Continue reading

Risks Associated With Investments

In the context of an investment, a situation of certainty is one in which the return from the investment is known for sure. Let us say, an individual invests in government securities and holds them to maturity. The individual can be sure about the redemption of the amount invested on maturity and payment of interest. Therefore, his/her rate of return is known for sure. The term risk, in the context of investments, refers to the variability of the expected returns. It is an attempt to quantify the probability of the actual return being different from the expected return. Though there is a subtle distinction between uncertainty and risk, it is common to find the use of both the terms interchangeably. Types of Risks associated with Investments The variability of the return or the risk can be segregated into many components, based on the factors that give rise to it. Broadly, Continue reading

Stock Beta – Meaning, Calculation, Applications and Types

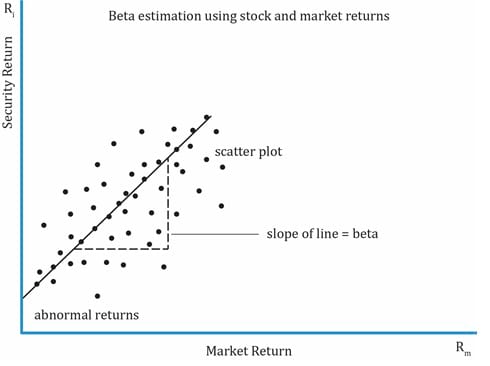

In finance, the Beta (β) of a stock or portfolio is a number describing the correlated volatility of an asset in relation to the volatility of the benchmark that said asset is being compared to. This benchmark is generally the overall financial market and is often estimated via the use of representative indices, such as the S&P 500, Nifty, Sensex, etc. Beta is also referred to as financial elasticity or correlated relative volatility, and can be referred to as a measure of the sensitivity of the asset’s returns to market returns, its non-diversifiable risk, its systematic risk, or market risk. On an individual asset level, measuring beta can give clues to volatility and liquidity in the marketplace. In fund management, measuring beta is thought to separate a manager’s skill from his or her willingness to take risk. The beta coefficient was born out of linear regression analysis. It is linked to a regression analysis of the returns of a portfolio (such as a stock index) (x-axis) in a specific period versus the returns Continue reading

Basics of Commodity Futures Markets

Futures markets have been described as continuous auction markets and as clearing houses for the latest information about supply and demand. They are the meeting places of buyers and sellers of an ever-expanding list of commodities that today includes agricultural products, metals, petroleum, financial instruments, foreign currencies and stock indexes. Trading has also being imitated in future contracts , enabling option buyers to participate in future market with known risks. In other words Futures markets have been described as continuous auction market and as a clearing house for the latest information about supply and demand. Participants in Future Market The following are the participant in future market which are as follows: Hedgers: Hedgers are individuals and firms that makes purchases and sales in the future market solely for the purpose of establishing a known price level —weeks or month in advance -for something Continue reading

Different Types of Swaps

In finance, a SWAP is a derivative in which two counterparties agree to exchange one stream of cash flow against another stream. These streams are called the legs of the swap. Conventionally they are the exchange of one security for another to change the maturity (bonds), quality of issues (stocks or bonds), or because investment objectives have changed. A swap is an agreement to exchange one stream of cash flows for another. Swaps are most usually used to: Switch financing in one country for financing in another To replace a floating interest rate swap with a fixed interest rate (or vice versa) In August 1981 the World Bank issued $290 million in euro-bonds and swapped the interest and principal on these bonds with IBM for Swiss francs and German marks. The rapid growth in the use of interest rate swaps, currency swaps, and swaptions (options on swaps) has been phenomenal. Continue reading