Traditionally, economics and finance have focused on models that assume rationality. The behavioral insights have emerged from the application of insights from experimental psychology in finance and economics. Behavioral finance is relatively a new field which seeks to provide explanation for people’s economic decisions. It is a combination of behavioral and cognitive psychological theory with conventional economics and finance. Inability to maximize the expected utility (EU) of rational investors leads to growth of behavioral finance within the efficient market framework. Behavioral finance is an attempt to resolve inconsistency of Traditional Expected Utility Maximization of rational investors within efficient markets through explanation based on human behavior. For instance, Behavioral finance explains why and how markets might be inefficient. An underlying assumption of behavioral finance is that, the information structure and characteristics of market participants systematically influence the individual’s investment decisions as well as market outcomes. Investor, as a human being, processes Continue reading

Stock Investments

Stock Beta – Meaning, Calculation, Applications and Types

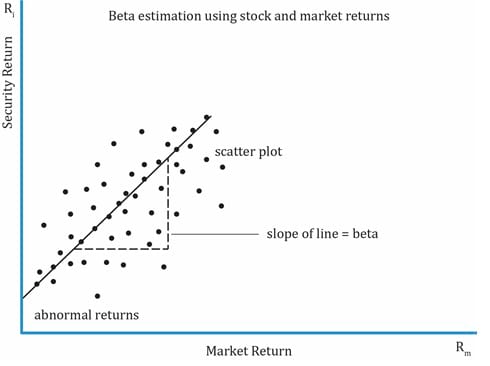

In finance, the Beta (β) of a stock or portfolio is a number describing the correlated volatility of an asset in relation to the volatility of the benchmark that said asset is being compared to. This benchmark is generally the overall financial market and is often estimated via the use of representative indices, such as the S&P 500, Nifty, Sensex, etc. Beta is also referred to as financial elasticity or correlated relative volatility, and can be referred to as a measure of the sensitivity of the asset’s returns to market returns, its non-diversifiable risk, its systematic risk, or market risk. On an individual asset level, measuring beta can give clues to volatility and liquidity in the marketplace. In fund management, measuring beta is thought to separate a manager’s skill from his or her willingness to take risk. The beta coefficient was born out of linear regression analysis. It is linked to a regression analysis of the returns of a portfolio (such as a stock index) (x-axis) in a specific period versus the returns Continue reading

Difference Between Forwards and Futures Contract

For all practical purposes, when a forward contract is standardized and dealt in an organized exchange, it becomes a future contract. Basically, they both seem to be one and the same. However, they differ from each other in the following respects: Nature of the Contract: A forward contract is not at all a standardized one. It tailor made contract in the sense that the terms of the contract like quantity, price, period, date, delivery conditions etc. can be negotiated between the parties according to their convenience. On the other hand, a futures contract is a highly standardized and they can not be altered to the requirements of the parties to the contract. Existence of Secondary Market: Since forward Contract is a customized contract, it is not a standard one. So, it cannot be traded on an organized exchange. With a result, there is no secondary market for a forward Continue reading

Basics of Commodity Futures Markets

Futures markets have been described as continuous auction markets and as clearing houses for the latest information about supply and demand. They are the meeting places of buyers and sellers of an ever-expanding list of commodities that today includes agricultural products, metals, petroleum, financial instruments, foreign currencies and stock indexes. Trading has also being imitated in future contracts , enabling option buyers to participate in future market with known risks. In other words Futures markets have been described as continuous auction market and as a clearing house for the latest information about supply and demand. Participants in Future Market The following are the participant in future market which are as follows: Hedgers: Hedgers are individuals and firms that makes purchases and sales in the future market solely for the purpose of establishing a known price level —weeks or month in advance -for something Continue reading

Different Types of Swaps

In finance, a SWAP is a derivative in which two counterparties agree to exchange one stream of cash flow against another stream. These streams are called the legs of the swap. Conventionally they are the exchange of one security for another to change the maturity (bonds), quality of issues (stocks or bonds), or because investment objectives have changed. A swap is an agreement to exchange one stream of cash flows for another. Swaps are most usually used to: Switch financing in one country for financing in another To replace a floating interest rate swap with a fixed interest rate (or vice versa) In August 1981 the World Bank issued $290 million in euro-bonds and swapped the interest and principal on these bonds with IBM for Swiss francs and German marks. The rapid growth in the use of interest rate swaps, currency swaps, and swaptions (options on swaps) has been phenomenal. Continue reading

Calculation of Exchange Rates for Forward Contracts

When computing exchange rates for merchant transactions, the cover or the base rate at which the cover transaction can be undertaken in the Forex market is first computed, thereafter the profit margin as allowed by the Foreign Exchange Dealer’s Association of India (FEDAI) is taken and the rate rounded off as per FEDAI Rule. In case of forward contracts, the procedure is similar except that while computing the base rate, the forward margin has to be appropriately taken. The forward margin is the extent to which the forward rate for a currency differs from its spot rate against a second currency. The forward margin when it tends to make a currency cheaper is called a ‘Discount’ while if it makes it costlier it is called a ‘Premium.’ Obviously if one currency is getting cheaper in the forward against another, the second should be getting costlier against the first. Thus while Continue reading