In today’s dynamic business environment, organisations are subject to a myriad of influences that shape their operations, strategies, and overall performance. These influences can be broadly categorised into internal and external factors, each playing a crucial role in determining a company’s success or failure. By understanding these influences, businesses can develop robust strategies to navigate challenges and capitalise on opportunities in an ever-changing marketplace. Internal Influences on Business Environment 1. Organisational Structure and Culture One of the most significant internal influences on a business is its organisational structure and culture. The way a company is structured can greatly impact its efficiency, decision-making processes, and overall performance. Organisational structure defines how tasks are formally divided, grouped, and coordinated within a company. A well-designed structure can facilitate communication, enhance productivity, and foster innovation. Conversely, a poorly designed structure may lead to inefficiencies, conflicts, and reduced performance. Organisational culture, on the other hand, refers Continue reading

Strategic Management Basics

Mergers and Acquisitions (M&A) – Definition, Types, and Process

Mergers and Acquisitions (M&A) are increasingly becoming a novel approach for companies to wade through the competitive pressures of today’s globalized society. The increase of mega-mergers in today’s corporate world demonstrates the entrenchment of such transactions in modern business practices. Definitions of Mergers and Acquisitions “One plus one equals three”. This statement defines the main logic that informs merger and acquisition transactions. This logic stems from the fact that most companies aim to create a bigger shareholder value than the sum of the shareholder value that would ordinarily be realized if two corporate entities merge. The reasoning behind merger and acquisition transactions therefore stems from the fact that there is a greater value when two companies work together, as opposed to two companies working in isolation. Mergers and Acquisitions (M&A) are therefore joint activities where the activities of two or more companies merge to create one common purpose for both Continue reading

Cultural Integration in Mergers and Acquisitions

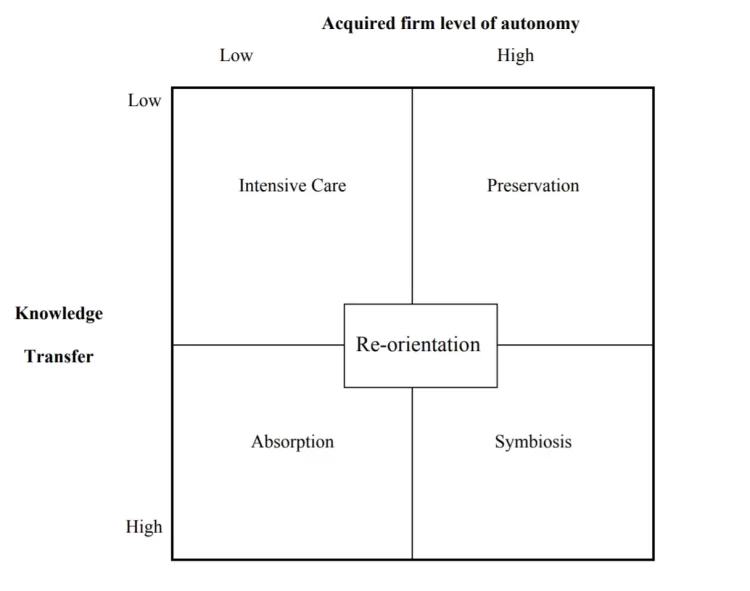

First, it is necessary to understand why the field of cross-cultural differences is vital to business interactions. In many situations, it is beneficial for companies to merge. Some businesses are failing to perform on their own, but still possess resources that may be valuable for businesses in the same sphere. Other companies aim to expand to increase their growth and support the rising demand for their services. Overall, joint ventures and alliances happen to raise the value of the merging entities, whether this value is connected to the brands presence, technologies and other resources or economies’ scaling. Cross-border acquisition and merger can be motivated by these factors as well – companies often want to enter new markets, for which international collaboration is essential. Its unique challenge, however, is that the market the foreign company is entering is completely new to it in many aspects. Merger and acquisition (M&A) are processes Continue reading

Free Cash Flow Theory of Mergers and Acquisitions (M&A)

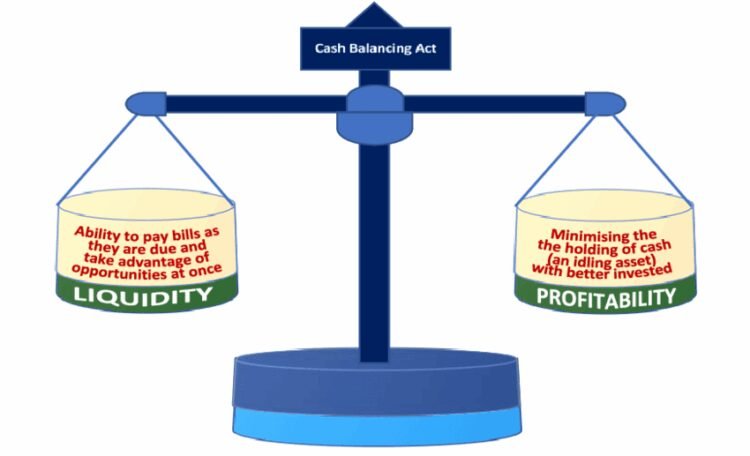

In the late 1980s, Jensen (1987) introduced the free cash flow theory to explain the financial decisions of managers in investing surplus money (excess cash flow). The free cash flow theory stems from the availability of corporate funds, after the deduction of all expenses. Managers often use this fund for purposes of expanding their businesses or paying out dividends to their shareholders. However, studies shows that many managers prefer to use this excess cash to enter into merger and acquisition agreements. Their incentive may be higher profitability and business advantages that mergers and acquisitions offer (compared to other investments). Occasionally, despite the failure of some investments to increase shareholder value, managers may decide to use these funds to expand businesses (through these mergers and acquisitions). They often prefer this option because the second alternative of paying out dividends to shareholders leads to the loss of financial resources and managerial power. Continue reading

Strategic Planning Tools – SPACE, GRAND, and QSP Matrices

Strategic planning is an integral part of a successful company’s operations and processes. It allows organizations to assess their positions within industries and define the steps necessary to solve issues or rise to a higher level. Strategic planning may be performed using different tools, including SPACE, Grand, and QSP matrices. While all three are effective and helpful, the last one is implemented during the final stage of strategic planning. 1. SPACE Matrix Overall, the SPACE matrix is a specific strategic management tool that companies use to analyze their positions. SPACE stands for the Strategic Position and Action Evaluation, focusing on strategy formulation and especially the improvement of competitiveness. It has four quadrants, each defining the specific temperament of the strategy to choose: competitive, defensive, conservative, and aggressive. Further, the Y-axis top is financial strength, and the bottom is environmental stability, being the factors of the external environment. The right of Continue reading

Growth and Success of an Enterprise – Factors and Stages

There exists several factors which contribute to the growth and success of an enterprise and among the leading factors is the age of the firm. To explain why smaller and younger firms are likely to grow faster than old and large enterprises is explained in economics by the use of the concavity of the production function. Where at the start, the small capital invested has the capability of multiplying exponentially but as time moves on and new investments are injected in to the investment, the marginal rate of productivity of the invested capital declines and that explains the reason why young firms grow faster than old and already established enterprises. Although many experts indicate that as the firm ages the likelihood of it learning form its mistakes and thus succeeding are high, the multiplier effect of large business is low and this is a major contributor to the success of an Continue reading