Mergers and Acquisitions (M&A) are increasingly becoming a novel approach for companies to wade through the competitive pressures of today’s globalized society. The increase of mega-mergers in today’s corporate world demonstrates the entrenchment of such transactions in modern business practices. Definitions of Mergers and Acquisitions “One plus one equals three”. This statement defines the main logic that informs merger and acquisition transactions. This logic stems from the fact that most companies aim to create a bigger shareholder value than the sum of the shareholder value that would ordinarily be realized if two corporate entities merge. The reasoning behind merger and acquisition transactions therefore stems from the fact that there is a greater value when two companies work together, as opposed to two companies working in isolation. Mergers and Acquisitions (M&A) are therefore joint activities where the activities of two or more companies merge to create one common purpose for both Continue reading

Strategic Management Concepts

Case Study: The Daimler Chrysler Failed Merger

In 1999, the Daimler Benz corporation of Germany merged with the Chrysler Corporation. In merging, the two companies aimed to create a company with a global presence and to bring the strengths that each company had to the global automobiles market. At first sight, the companies appeared to be equal partners in the merger. The companies at the time of the merger were almost equal in size. In addition, the companies appeared ideal for a merger because each had specific strengths which could be complemented by the other. Chrysler, founded and having its main operations in the US, was a company that emphasized innovation and flexibility while its counterpart, Daimler Benz, was a company characterized by structured, hierarchical management and German engineering excellence. These apparent equal partners were thus ideal for a mutually beneficial merger. In addition, the two companies were among the market leaders in their areas of specialization, and their Continue reading

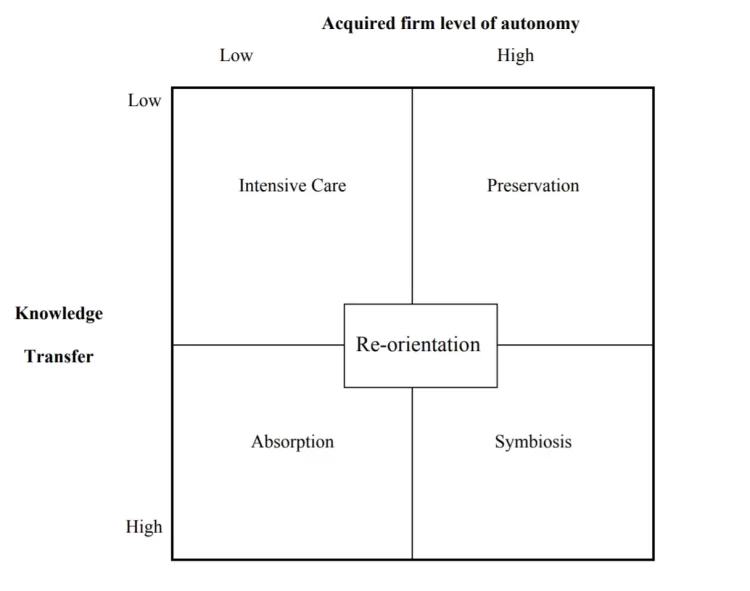

Cultural Integration in Mergers and Acquisitions

First, it is necessary to understand why the field of cross-cultural differences is vital to business interactions. In many situations, it is beneficial for companies to merge. Some businesses are failing to perform on their own, but still possess resources that may be valuable for businesses in the same sphere. Other companies aim to expand to increase their growth and support the rising demand for their services. Overall, joint ventures and alliances happen to raise the value of the merging entities, whether this value is connected to the brands presence, technologies and other resources or economies’ scaling. Cross-border acquisition and merger can be motivated by these factors as well – companies often want to enter new markets, for which international collaboration is essential. Its unique challenge, however, is that the market the foreign company is entering is completely new to it in many aspects. Merger and acquisition (M&A) are processes Continue reading

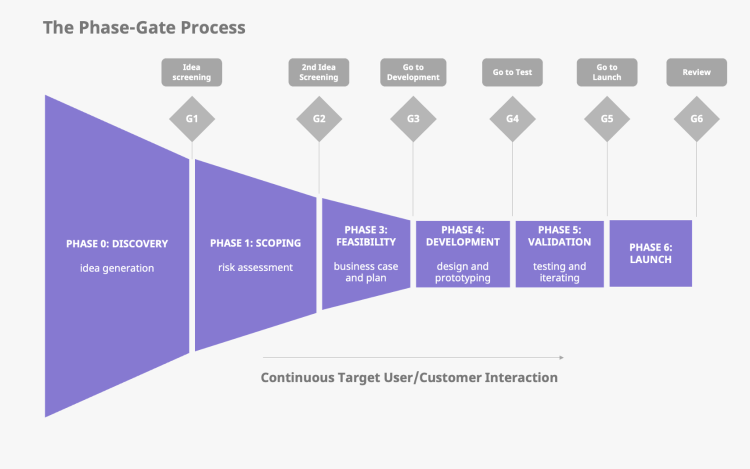

Cooper’s Stage Gate Model in Product Development

Cooper’s Stage Gate process focuses on innovations during project management/product development. The stage gate process, a notable project management technique pioneered by Dr. Robert G. Cooper in the early ’80s, systematically breaks down a project into distinct, manageable stages, punctuated by decision points known as gates. At these gates, the project’s progress is critically evaluated against predefined benchmarks, determining whether the project should progress, be adjusted, or discontinued. Entrepreneurs use a set of approaches and tools to assess the viability and potential of ideas and profit from them by developing and launching products. Cooper’s stage gate process model is one such approach that is key to any product or service in the commercial or non-commercial sector. Cooper’s stage gate process model is critical to the processes and performance of an organization as it reduces production errors and therefore saves the company from losses. This technique divides a project into different Continue reading

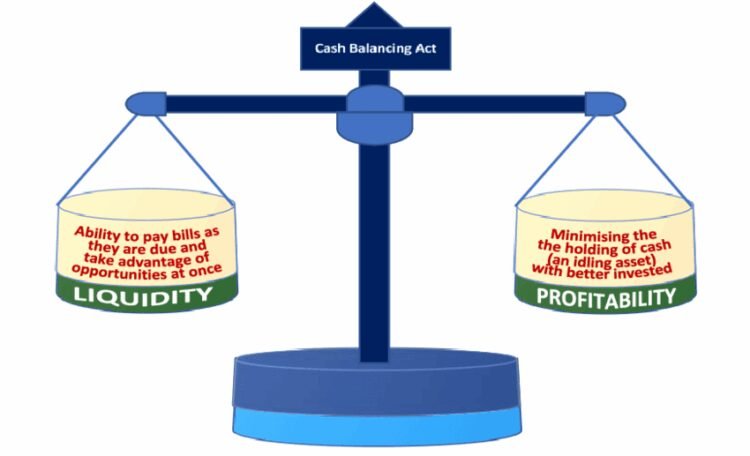

Free Cash Flow Theory of Mergers and Acquisitions (M&A)

In the late 1980s, Jensen (1987) introduced the free cash flow theory to explain the financial decisions of managers in investing surplus money (excess cash flow). The free cash flow theory stems from the availability of corporate funds, after the deduction of all expenses. Managers often use this fund for purposes of expanding their businesses or paying out dividends to their shareholders. However, studies shows that many managers prefer to use this excess cash to enter into merger and acquisition agreements. Their incentive may be higher profitability and business advantages that mergers and acquisitions offer (compared to other investments). Occasionally, despite the failure of some investments to increase shareholder value, managers may decide to use these funds to expand businesses (through these mergers and acquisitions). They often prefer this option because the second alternative of paying out dividends to shareholders leads to the loss of financial resources and managerial power. Continue reading

Strategic Planning Tools – SPACE, GRAND, and QSP Matrices

Strategic planning is an integral part of a successful company’s operations and processes. It allows organizations to assess their positions within industries and define the steps necessary to solve issues or rise to a higher level. Strategic planning may be performed using different tools, including SPACE, Grand, and QSP matrices. While all three are effective and helpful, the last one is implemented during the final stage of strategic planning. 1. SPACE Matrix Overall, the SPACE matrix is a specific strategic management tool that companies use to analyze their positions. SPACE stands for the Strategic Position and Action Evaluation, focusing on strategy formulation and especially the improvement of competitiveness. It has four quadrants, each defining the specific temperament of the strategy to choose: competitive, defensive, conservative, and aggressive. Further, the Y-axis top is financial strength, and the bottom is environmental stability, being the factors of the external environment. The right of Continue reading