There are four perspectives or views on strategy, the classical approach to strategy, evolutionary perspective on strategy, processual approach to strategy and systematic perspective on strategy. Their features are described below. 1. Classical Perspective on Strategy In the classical approach to strategy perspective, profit is seen as the ultimate objective of the firm and profit targets can only be attainable through rational planning by the firm’s management. This perspective was designed by a businessman and historian Alfred Chandler, a theorist Igor Ansoff and a businessman Alfred Sloan. The perspective is based on three assumptions and they include; rational analysis, distinguishing conception from execution and the commitment of firms to maximize their profits. The major question is to position a business in markets where profits are likely to be maximized. The aim of the perspective is to ensure that there are returns on capital, and in this case, a focus on the Continue reading

Strategic Management Concepts

Unitarist Perspective Vs. Pluralist Perspective in Management

People have different ways of interpreting the events they come across in their daily life. School and family circumstances, encounters at the workplaces, clubs, religions, friends, society, and occupations influence most of the understandings. Employment is one of the elements that influence people’s life. Hence, management and the nature of employment are some of the issues that trigger heated debates. Generally, people have two different perspectives of interpreting managerial practices that take place at workplaces. These are known as unitarism and pluralism. The unitarist approach holds that workplace conflicts are avoidable. According to this approach, managers may detour them by bringing all the stakeholders together. They can and should make sure that an organization is managed from a single source of power. Meanwhile, pluralists hold that workplace conflicts are inevitable. Managers ought to convert them into profitable initiatives rather than criticize them. Unitarist Perspective Unitarists base their arguments on postulations that workplace conflict Continue reading

The ADKAR Model of Change Management

Change management can be characterized as the procedure of altering or changing one or more angles of an association utilizing a planned system. Change management includes the implementation of one or more techniques, which organizations use to increment effectiveness and acquire their objectives. Theorists have provided different concepts of change management simply to understand the framework according to which organizations manage and lead change. The Prosci ADKAR model is one of the best approaches introduced several years ago to support change in companies through the prism of its five major elements, namely awareness, desire, knowledge, ability, and reinforcement. The progress of the ADKAR model is evident today due to its evident advantages and the possibility to facilitate working processes. Prosci’s ADKAR Model of Change Management Prosci’s ADKAR Model is a goal-oriented change management model that guides individual and organizational change. Created by Prosci founder Jeff Hiatt, ADKAR is an acronym Continue reading

Strategy Development and Leveraging Core Competencies

Strategy allows an organisation to deliver its vision. To develop a deliberate strategy which could potentially increase the sustainability of an organisation clearly requires the identification of core competencies but often a single strategy is not the answer. Organisations require a headline strategy to fit a brief which resonates the vision but several strategies are required over many departments such as research and development, production and marketing to deliver the main strategy. The process of strategy development is complex and methodology depends on several factors including the availability of resources and the external environment. The second step in strategy development following identification of core competencies, which is the process of leveraging resources so they can be exploited for maximum benefit. An organisation’s resources can be tangible, intangible or human and that these can be matched to its capabilities to eventually provide competitive advantage. This process of exploiting the unique combination Continue reading

Transferring Core Competencies for Organization Success

Development and expansion organizations’ core competency is one of the main success factors of many organizations. However, if organizations do not apply correct measures when transferring core competencies for one business to another, the likelihood of failure is high. Transfer of core competencies is one of the most important business diversification strategies of ensuring organizations reduce costs of starting over again in new business ventures. Transferring core competencies and resource strengths from one country market to another is a good way for companies to develop broader or deeper competencies and competitive capabilities that can become a strong basis for sustainable competitive advantage. It mostly works via capitalizing on operational relatedness, primarily applying the constrained multi-product strategy. This strategy offers organizations a chance of realizing and exploiting economies of scope, a crucial pathway for gaining a competitive advantage over other businesses. In addition, it guarantees organizations opportunities for utilizing existing expertise Continue reading

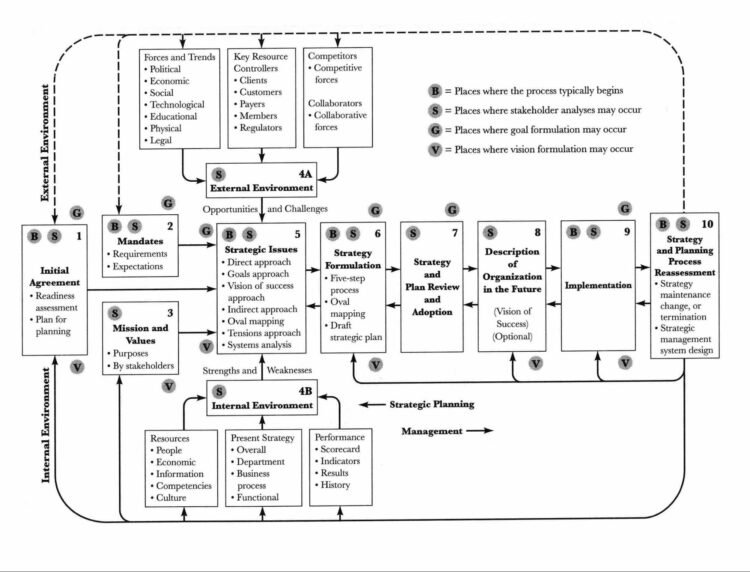

Strategic Management Model: Bryson’s Strategy Change Cycle for Strategic Planning

In ensuring effective strategic change in an organization, strategic planning is inevitable for organizations to develop and implement strategies through the strategy change cycle. A strategic change cycle is a systematic procedure that is indispensable in determining whether an organization will be successful. The strategy change cycle is among the primary processes of strategic management that links the processes of planning and implementation and ensures that the process is carried out consistently and in alignment with specific organizational goals. The following section discusses ten vertical steps in the change cycle by keenly describing why they are essential for organizations in planning and implementing their strategies. Its purpose is to develop a consistent commitment to the mission and vision of an organization, both internally and externally, at the same time with maintaining a clear focus on the organizational agenda with the help of relevant activities and decision-making processes. Strategy Change Cycle Continue reading