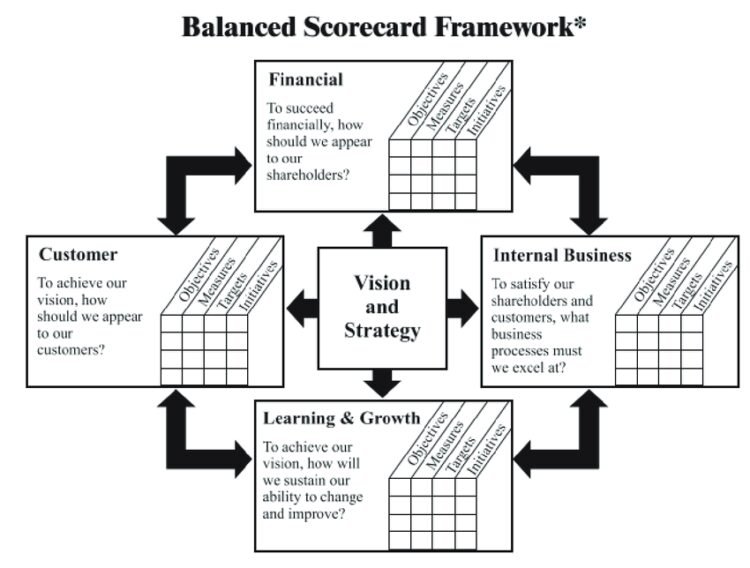

For modern organizations, it is essential to have methods for collecting data and making decisions based on the strategic objectives that lead to the achievement of competitive advantage. The balanced scorecard (BSC) represents strategic planning and management that companies use for communicating their intended accomplishments, aligning everyday procedures with the formulates strategy, monitoring progress, and prioritizing projects. In general, BSC is used for measuring and providing feedback to organizations, with data collection being crucial to the provision of quantitative results. This data is interpreted by managers and executives who make further decisions for an organization. The concept of Balanced Scorecard (BSC) was first introduced by Kaplan and Norton who received great praise for their research. The key principle behind the concept lies in finding balance across all functions of an organization since the majority of companies focus on financial measures such as growth and profitability, forgetting about such sectors as Continue reading

Strategic Management Concepts

Business Strategy Implementation

The business strategy will be implemented through the concerted actions of all staff working within a partnership framework. The Board will set objectives and parameters, for the business strategy implementation, and will review progress in achieving objectives. Management will take ownership, give leadership and agree with staff clearly defined roles and responsibilities in achieving targets and milestones. It is also recognized that resources issues may affect the full implementation of the strategy. To assist management in carrying out its role in delivering the strategy and whatever may evolve in the future, an integrated management development programme, with a particular focus on business planning and performance management, will a particular focus on business planning and performance management, will be provided. It is anticipated that other issues will emerge as the process evolves. The project groups will comprise of management and staff, at all levels, who have expressed an interest, and who Continue reading

Strategic Outsourcing

The opposite of integration (a firm’s growth, in number of businesses) is outsourcing value-creation activities to subcontractors. In recent years there has been a clear move among many enterprises to outsource non-core or non-strategic activities. Any function can be outsourced, if it is not critical to a firm’s success (is not one of its distinctive competencies). Outsourcing begins with a identification of a firm’s distinctive competencies–these will continue to be performed within the company. All other activities are then reviewed to see whether they can be performed more effectively and efficiently by independent suppliers. If they can, these activities are outsourced to those suppliers. The relationships between the company and those suppliers are then often structured as long-term contractual relationships. The term virtual corporation has been coined to describe companies that have pursued extensive strategic outsourcing. Advantages of Strategic Outsourcing There are several advantages of strategic outsourcing. First, by outsourcing Continue reading

Business Level Strategy vs Corporate Level Strategy

Business level strategy is defined as an organizational strategy that seeks to determine how an organization should compete in each of its businesses. In contrast, corporate level strategy is an organizational strategy that seeks to determine what business a company should be or wants to be. At the heart of business level strategy is the role of competitive advantage. This is what sets a company apart from its competitors and gives it a distinct edge. Sustaining competitive advantage will be based on the interplay of the five forces in an industry. According to Porter (1990), these five forces are the threat of new entrants, the threat of substitutes, the bargaining power of buyers, the bargaining power of suppliers and rivalry among firms. By performing an industrial and internal analysis, a firm can then identify its competitive advantages so that it can pursue the right strategy. There are a few major Continue reading

Stakeholder Theory and Corporate Governance

In contemporary society, business organizations are taking on an increasingly complex and significant role. Some corporate giants control vast resources and possess enormous influence in human daily life. Especially when they enter areas such as health care and education, they can have a more deep relationship and powerful impact on society. However, the nature of business activities is to pursue the best interests and it could lead to some conflicts between different stakeholders. Thus, proper corporate governance needs to be used to ensure corporates continue operating on a normal track. In theory, corporate governance is a kind of system that could direct and control companies. The object of corporate governance is to make maximum profit for shareholders in the past. Unfortunately, it has been considered one of the most root causes of the governance crisis in recent times. On the one hand, excessive pursuit of share price performance has neglected Continue reading

Role of Employee Involvement in Organizational Change

Employee involvement is known as the direct involvement of the organizational staffs in the growth, development and benefits of the company. This involvement can be with voice, participation, engagement and in democracy. These factors help the organization to improve its decision-making, improve the attitude of the employees towards work, increase the job satisfaction, and empower their employees with facilities for better health and life. To engage the employee in the organization, they should be given with the authority to become effective to take participate in substantive decisions, providing the training for appropriate decision-making skills and provide them rewards or incentives with successful participation. On the other hand, the organizational change is a process that refers to the modification or transformation of the organizations structure, work culture and goods. It has impact on the working of the employees and can also affect the work culture, infrastructure or to the process of Continue reading